Market saturation is a measure of the amount of supply for a given level of demand. The more supply, the greater the amount of saturation. All things being equal, the more saturated a market is, the more difficult it could be to compete. Calculating and understanding market saturation will help you as a small business owner create strategies that will help you succeed.

Market research for your business plan is obviously critical. In addition to analyzing demand, market size, economic indicators, and location you’ll also want to know how much and what type of competition your face. You want to know how saturated your market is.

This is all a lot of work. But, I feel it’s important to help you stay competitive. Not only when you’re writing your business plan, but throughout the remainder of the life of your business. Understanding your customers and your competitors will help you to be more successful.

More market saturation can mean a smaller market share

Market share is exactly what it sounds like. It’s your share (percentage) of the market for your company’s goods and services. That’s the simple explanation.

What’s considered your market and what goods/services you’re referring to it’s up to whoever is calculating the market share.

On my sister site, InvestSomeMoney.com, I have talked extensively about total available market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM). Of these, the SAM is what I would advise for you to consider when calculating market share.

Also, many businesses, probably yours even, sell a variety of products and or services. Therefore their market share might vary in terms of what they’re selling. It might be that they have a dominant market share in one category, and a poor market share in another.

Market saturation is a situation where there is no unmet demand for a given product or service. This can happen from businesses entering the market, businesses growing, or from demand shrinking.

The market can be saturated if there’s only one business in it. Of course, that’s referred to as a monopoly. In other markets, particularly those that deal with commodities, the market could be saturated due to an overabundance of competitors. So, the number of businesses in the market isn’t necessarily indicative of whether or not it’s oversaturated. Again, it has to do with supply vs. demand.

Strategies for competing in a saturated market

There are five basic strategies for combating market saturation. For more details on business growth strategies read this post on InvestSomeMoney.com.

Market penetration

Market penetration means taking market share away from competitors.

This can be done in a couple of different ways.

The first is pricing. Lower prices, all things being equal, can take customers away from the competition. As a new business, you might not have the cost structure or processes in place to make the margins that you need if you compete on price. Alternatively, you can raise prices and present your product/service as a premium offering. This can work if you can truly isolate what is it that makes your offering unique.

Additional value is another way to penetrate the market. A better experience, upgrades, and loyalty programs are a few ways to do this.

Market development

Market development means focusing on an unsaturated geographic area.

If your first choice for location is saturated, perhaps your second, third… whatever choice might not be. In fact, your business model might have market development worked into it by design. If your plan is to start a franchise or to market your products through a network of distributors, then you will be planning on developing new markets in the future

Product expansion

Product expansion is the creation of new products or services which don’t yet have a saturated market.

Creating a new unique product/service is one of the most effective ways to penetrate a new market. We all know the cliché about building a better mousetrap.

Your new product/service doesn’t necessarily have to be revolutionary. It can be a minor improvement to something that already exists. It can even be something that has extraneous and unnecessary features (without huge benefits) stripped away.

Diversification

Diversification is the combination of market development and product expansion.

Diversification is really just a hybrid of the above strategies. The combination of any two or more ways to break into a saturated market.

For instance, a franchise restaurant that offers a half chicken and half beef sandwich. That’s a silly example but it shows you what the combination of market development and product expansion might look like.

Acquisition

Acquisition is investing in another company in order to capitalize on their market share.

If you’ve got the capital, and the business plan, an acquisition, merger, joint venture, or alliance may be the way to break into a saturated market. In a case like this, you might purchase the sole vendor in town and open your own retail location. This would give you control of the supply and the costs. This control would put you in a strong position to increase market share.

How to calculate market saturation

First of all, before we begin, we should probably be pretty clear about what we want. Here’s a somewhat technical definition that we can use as a starting point:

Market saturation is defined by the relationship between supply and demand. Supply and demand for substitute products within a particular geographic area. The geographic area can be small, or it can encompass the entire world.

Alright, so what’s meant by that?

If the amount supplied by your potential competitors is greater than or equal to what’s demanded, then the market could be considered saturated. However, getting an accurate read on the supply and demand for a particular product/service can range from time-consuming to damn near impossible.

Don’t let that discourage you. The point of writing a business plan, in general, and calculating market saturation, in particular, is to think things through thoroughly. To look at your aspiring business and the environment it operates in as comprehensively as possible.

So, you’ll have to work with what you have. It might be a little or a lot of information. That’s more abstract than I like to be. But, that’s the way it is. Every industry/business is different. So, I, unfortunately, can’t prescribe any “one way” to calculate market saturation.

I can, however, give you some guidelines and provide an example…

Use a benchmark

Credit for this idea goes to this slideshow.

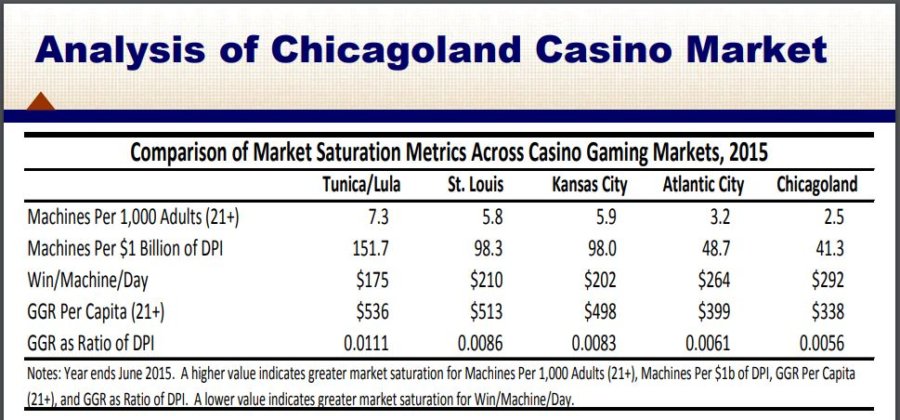

In this example, the market saturation of a casino in the Chicagoland area was analyzed.

It was compared to areas that were assumed to already be saturated with casinos. This was done through the use of ratios calculated with demographic and industry data.

The authors of this slideshow probably didn’t know the exact demand for a casino in the Chicagoland area. How could they? Even if they could survey every individual living there, the demand information they gathered might not be reliable.

So, they did the next best thing – they used a benchmark.

Now, St. Louis, Kansas City, et al. may or may not really be saturated with casinos. However, if Chicagoland’s ratios (machines per 1K adults, machines per $1B of disposable income, etc.) are more favorable, it probably doesn’t matter. From a market saturation standpoint, the Chicagoland area is probably more favorable for a casino. If the Chicagoland casino fails, it probably won’t be due to market saturation.

Start with what you know (or, at least, what you’re pretty sure of)

What’s something similar to your product/service that’s got a saturated market? Where’s somewhere similar to your business location that you’re pretty sure is saturated? These can serve as your benchmarks.

I would suggest that you refer back to your business plan demand analysis. In particular to the drivers of demand. Hopefully, these will give you an idea for the metrics to use for comparison.

In the casino example, demand drivers such as population (21+) and disposable income were used.

Once you have a grasp on the demand side of the equation, you’ll need some supply figures. Again, use the best information you can get your hands on. This may come from an industry publication, an internet search, or just information you already know. If all that fails, you might have to use a proxy, as I did below.

In the casino example, they used industry information on the supply side. Things like gaming machines/facilities and revenue.

With demand and supply information in-hand, you can now calculate ratios. Do this for your own business and for the benchmark that you know is saturated.

Compare the results. If your prospective business looks more favorable – great! You might not have to fight a saturated market. If things don’t look so good, don’t give up. Consider which of the above strategies you could employ. Or tweak your business plan somewhat.

Consider a soaking wet rag. It might be completely saturated and unable to hold any more water. If you add one more drop, a drop will fall off of it. Your business might be the drop that’s added, but that doesn’t mean it’s the drop that will fall off.

An example of calculating market saturation

As with all of my business plan posts, I’m going to work alongside you. For those who are new to these posts, my potential business is for a natural, topical, hair regrowth treatment.

Let’s start with a benchmark. Something that, I assume, has a saturated market. This took a little bit of thought.

I wanted to stack my potential product against something that everyone uses. A commodity that has a negligible amount of distinction between products. I also wanted something that had separate men’s and women’s versions.

So, I settled on “shaving razors.”

The supply of the benchmark

How many shaving razors are supplied, though? Almost impossible to say for sure. But, I thought that Amazon might provide some insight.

So, I did searches for:

- “mens shaving razor” in the “men’s shaving & hair removal products” category

- “womens shaving razor” in the “women’s shaving & hair removal products” category

For each search, I estimated the number of results (excluding sponsored results). I figured that, for a commodity such as shaving razors, nearly every company that sold them would offer them on Amazon.

Sure, substitute products and other unrelated items came up in these searches. But, since that’s the case across all my searches – it’s fine. It’s all about the relative number of search results, not the exact number.

Demand for the benchmark + results

Next, I needed to know the demand for shaving razors. I decided to use males 20+ and females 15+ in the U.S. as my population. That data was derived from this source.

Then, it was a simple matter of division. The demand (male and female shaving population) divided by the supply (Amazon.com search results) gives me a ratio that I can benchmark against.

Here’s what that looked like:

| Population | # search results | Pop ÷ results | |

|---|---|---|---|

| Males (20+) | 119,000,821 | 8,060 | 14,764 |

| Females (15+) | 136,348,759 | 1,560 | 87,403 |

This means, in theory, that 14,764 men could buy each and every search result for shaving razors. 87,403 women. Again, I know not every person in the U.S. buys their shaving supplies from Amazon. It’s just that ratio I’m after.

At this point, I don’t know if that’s good, bad, or neutral. In order to put things into perspective, I need to know what the ratio might look like for my product.

I’ll need the same basic information, just tweaked for my particular product.

For starters, I’ll refer back to my post on determining market size. Here, I determined that my conservative serviceable available market (SOM) was 680,293 males and 1,159,854 females. That’s my assumed demand.

Supply for my product

As far as supply goes, I’ll approach it from the same way. I’ll use Amazon, but I’ll, of course, perform a different search.

This time, I’ll search for “mens hair regrowth treatment” and “womens hair regrowth treatment”. Both will be in the same category, “hair regrowth treatment” since there is no distinct category for the two genders – as there was with shaving razors.

Though the first page of results pulled up very different products, the total number of results was the same – 1,092 for each.

Without further ado, here’s the results:

| Population | # search results | Pop ÷ results | |

|---|---|---|---|

| Males in SAM | 680,293 | 1,092 | 623 |

| Females in SAM | 1,159,854 | 1,092 | 1,062 |

Conclusions

What’s this mean? Way less Population per search result. That’s bad news.

I thought shaving razors would be the saturated market, but (wo)men’s hair regrowth treatment blew that out of the water. Only 623/1,062 people could buy every result in this market. That’s compared to over 87,000 in the women’s shaving razor market.

It turns out that hair regrowth treatments might be the saturated market. Boring ol’ razors (and other shaving acessories) might be where the opportunity is.

The numbers didn’t get any better when I used my SAM population instead of SOM. Though the populations were considerably bigger, the Pop ÷ results still paled in comparison to shaving razors.

As I was prepping for this post, I wondered if this wouldn’t be the case. Reviewing the information in my post on determining market size, I saw then that I was potentially demand-constrained (as opposed to supply-constrained). I saw then that I could make way more than I could practically hope to sell.

Going forward

What’s that mean for my prospective business?

First of all, it means that I’m glad that I performed this analysis for my business plan and didn’t dive in head-first.

It also doesn’t mean that there isn’t a business here. I just need to digest this information, circle back to some of the previous steps, and tweak my plan accordingly.