| Component | Type | % of the total (a) | Tax adjusted cost (b) | a × b |

|---|---|---|---|---|

| Retained earnings | Equity | 65% | 7.0% | 4.58% |

| Add’l paid-in capital | Equity | 19% | 12.2% | 2.28% |

| Borrowing 1 | Long-term debt | 14% | 4.0% | .55% |

| Borrowing 2 | Long-term debt | 2% | 3.6% | .07% |

| WACC = | 7.48% |

The WACC for a small business is the total cost of debt and equity.

Knowing its WACC helps a small business to make appropriate strategic decisions. For instance, the WACC can serve as a “hurdle rate” for capital budgeting and project selection.

Looking for more spreadsheet templates? Here’s 13 more…

14 EXCEL TEMPLATES THAT EVERY SMALL BUSINESS SHOULD BE USING

What does weighted average cost of capital (WACC) mean?

The WACC is the cost of financing a business’ operations. It is represented as a percentage.

Short-term financing is not included in the WACC calculation. Only long-term financing, e.g. equity and long-term debt or a hybrid thereof.

What is meant by weighted average?

Weighted average refers to the proportion of debt or equity that a particular source of financing makes up.

Consider a small business that has $1 million in equity with an expected cost of 7%. Let’s say, for some reason, they decide to borrow $1000 at a 30% interest rate. This is costly debt, no doubt. But, since the percentage of capital is so small (1/1,000), it will have relatively little effect on the WACC.

What is meant by cost of capital?

The cost of debt is pretty straightforward. It is measured by the interest rate charged on the debt.

WACC takes into account not only the cost of debt (interest rates) but also the cost of equity. Many people don’t think about the costs associated with equity. But, they are very real.

Equity can generally be considered in two forms. Retained earnings and additional paid-in capital.

The cost of retained earnings can be approximated by the expected growth rate of dividends.

Similarly, the cost of additional paid-in capital can be approximated but using something called the capital asset pricing model (CAPM).

A bit about the capital asset pricing model

The formula (and the Greek symbols contained therewithin) for the CAPM is beyond the scope of this post.

Just know that the CAPM seeks to calculate an expected return based on the perceived riskiness of an investment. So, since the cost of additional paid-in capital is basically the expected return by the owners of the business, we can approximate their expectations via the CAPM.

Thinking of setting up shop somewhere else? Read this post:

HOW TO CHOOSE THE BEST LOCATION FOR YOUR SMALL BUSINESS

Download the small business WACC calculator

Complete the form below and click Submit.

Upon email confirmation, the workbook will open in a new tab.

An example of the WACC

The WACC is valuable in choosing which projects to invest in. Read more here:

FREE TO DOWNLOAD – CAPITAL BUDGETING SPREADSHEET/TEMPLATE

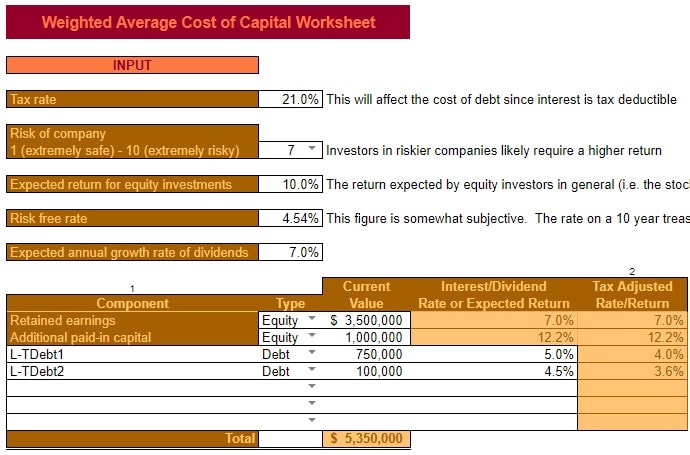

Let’s consider a small business owner who wants to know their company’s WACC.

They want to know because it will help them in their decision making. First and foremost it will help them to strive to minimize their WACC. Secondly, it will give them a hurdle rate to reference when they do capital budgeting.

Let’s say this small business is financed with both equity and debt. Equity has two Components, retained earnings, and paid-in capital.

As mentioned earlier, the cost of retained earnings is approximated by the expected annual growth rate of dividends. This small business owner does pay dividends. After reviewing their dividend payment history, they see that dividends have grown by an average of 7% per year. The amount of retained earnings they currently have on their books is $3.5 million.

Additional paid-in capital is the equity investment made by the owner or other investors. The cost of this Component is characterized by the expected return on investment in the business.

As mentioned above, the calculator uses the capital asset pricing model to give an approximate cost. You can use whatever you want to here, though. Just keep in mind the principles behind the CAPM when settling on an expected return.

For instance, think about the risk-free rate. No matter how good of a manager you are, investment in your company is probably riskier than a treasury note. Additionally, consider the expected return for equity investments – i.e. the stock market. In theory, you’re competing with those companies for investment dollars. How is your company perceived, risk wise, compared to an investment in an S&P index fund?

For this example, let’s assume that the expected return for additional paid-in capital is 9% on $1 million.

The debt portion of the WACC is a little more straightforward. Our example business owner simply looks at his latest statements and sees that he has two long-term loans outstanding.

One has a balance of $750,000 and an interest rate of 5%.

The other is $100,000 and an interest rate of 4.5%.

The example company also has a tax rate of 21%. This makes for tax-adjusted rates of 4.0% (5.0% × (1 – 21.0%)) and 3.6% (4.5% × (1 – 21.0%)) respectively.

The WACC equation for our example

The total of long-term debt and equity for our example company is $5,350,000. So, in order to determine the weighting for each component, we simply divide the Current Value of the Component by the Total. The rounded percentages are as follows:

Retained earnings – 65% ($3,500,000 ÷ $5,350,000)

Additional paid-in capital 19% – ($1,000,000 ÷ $5,350,000)

Long term debt of $750,000 – 14% ($750,000 ÷ $5,350,000)

Long-term debt of $100,000 – 2% ($100,000 ÷ $5,350,000)

Now it’s simply a matter of taking those percentages times the tax-adjusted rate/return.

Cost of retained earnings = 65% × 7.0% = 4.58%

+

Cost of additional paid-in capital = 19% × 12.2% = 2.28%

+

Cost of long-term debt = 14% × 4.0% = .55%

+

Cost of long-term debt = 2% × 3.6% = .07%

=

WACC of 7.48%

As you can see figuring the weighted average cost of capital isn’t too terribly difficult. Debt is easy. Equity is a little more subjective.

Retained earnings aren’t too hard if you’re going to use the expected annual growth rate of dividends as your cost. It’s additional paid-in capital that’s really is the most difficult to assign a cost to. Because it depends on several different variables and a lot of judgment.

You’ll notice that all of the variables talked about in this post can be entered into the WACC Small Business worksheet. So, if you’re not really up for manually figuring out your small business’ WACC, you can use this handy tool. It’ll even approximate the cost of your additional paid-in capital using a rough estimation based on a capital asset pricing model.