“How do I write a marketing plan?” Start by looking internally at your unique selling proposition and your pricing. With that foundation, you can be proactive and confident in your advertising, sales, and distribution strategy. All the while, you’ll want to be mindful of what the competition is doing so that you can copy what works and avoid what doesn’t.

An annual marketing plan and the marketing section of your business plan are essentially the same things. They’re both a plan of action for making more sales and bringing in more revenue. The latter is written when you’re getting ready to launch your business. The former can be written at any time; but, ideally, would be reviewed and revised at least annually.

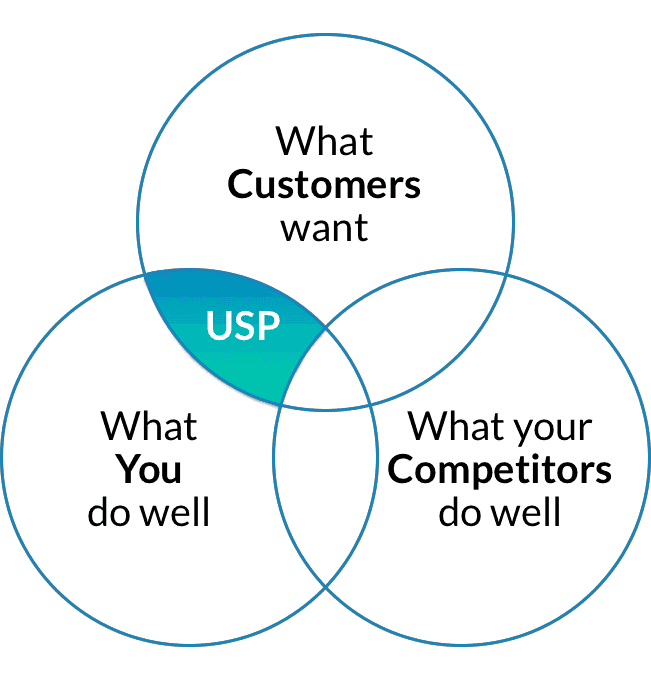

The first thing to address in your marketing plan is your unique selling proposition (USP). This is the foundation of all of your other marketing.

Next, the focus will turn to pricing. Pricing has an enormous effect on revenue. In fact, if your small business’s pricing is on point, that can probably make up for other shortcomings in your marketing plan.

With those issues addressed, you can now turn your focus to other activities that will directly impact customers. Specifically, your sales/distribution and advertising/promotion. Your business’s sales and distribution plan will involve direct contact with the customer. Conversely, your business’s advertising and promotion plan will be comprised of more indirect interactions with your prospective customers.

While working through the sections of your marketing plan, it’s critical that you refer to quality market research. When you were drafting your business plan, you probably had extensive market research handy. If you don’t have up-to-date market research at this time, I think it would be beneficial to brush up on that before writing a marketing plan.

What is a unique selling proposition (USP) in marketing

Every company has something unique about them. It might be in their products or services. Or, it could be some other aspect of their business.

Of course, your business is no exception. My advice, when considering your unique selling proposition, is to think about what your business is good at. What’s the one thing you do better than anyone else? It can be anything, even if it’s not an activity that directly affects customers.

If it’s an activity that doesn’t directly affect your customers, think about the second and third-order effects of that activity. Surely, you’ll discover that activity ultimately benefits customers in one way or another. Every activity that takes place within your small business (should) revolve around your customers. After all, they’re the ones that drive revenue. Without revenue, you wouldn’t bother doing any of those activities.

In addition to clarifying what’s unique about your company, you’ll want to revisit your products and services to solidify what benefits they provide your customers. Benefits are the reason that people buy products and services. make sure you’re not listing features during this exercise.

Customers don’t buy a saw because it can cut wood. They buy a means to get a board that’s exactly the right length. This is a good illustration of the distinction between the features and benefits

With a firm grasp on your USP and the benefits of your products and services clearly in mind, reviewing your pricing strategy should also be easier.

What are your competitors’ unique selling propositions?

Now, it’s time to think about what it is that your competitors do best. Nobody is the best at everything and everybody is the best at something. Even your less-than-stellar competitors have something that they do very well.

In a perfect world, your business would serve as much of the Total Obtainable Market as you wanted. As it stands, you’ll probably have to wrestle a share of that market from your competitors. Therefore, it pays to know what you’re up against.

Understanding your competitors’ unique selling propositions will help you with sales in particular. When leads and prospects bring up your competitors, you’ll be able to acknowledge what they do well. This will convey authenticity. You’ll also be prepared to counter with why your unique selling proposition makes your products and services a better fit for the customer.

What are pricing strategies in marketing?

Pricing is a tricky subject. Many entrepreneurs fear that if they price $.01 too high, they’ll not make any sales. Alternatively, it always nags at them that they may not be pricing high enough and therefore leaving revenue on the table.

To complicate matters, pricing is very subjective to customers. Presented with the same price, one customer might think a product or service is outrageously overpriced. Another might consider it a bargain.

I made an extensive video and a valuable spreadsheet to help small businesses solve the problem of pricing. Check that out if pricing is giving you trouble.

There is a multitude of pricing strategies that your small business can employ. Many of which can be combined together.

How much you decide to scrutinize pricing is up to you. However, I always suggest that if you’re weighing different price points common to go with the higher price. You can always improve your sales tactics and it’s easier the lower prices via a promotion than it is to raise them.

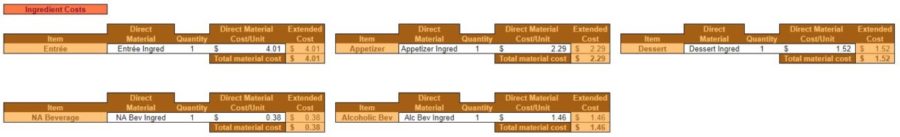

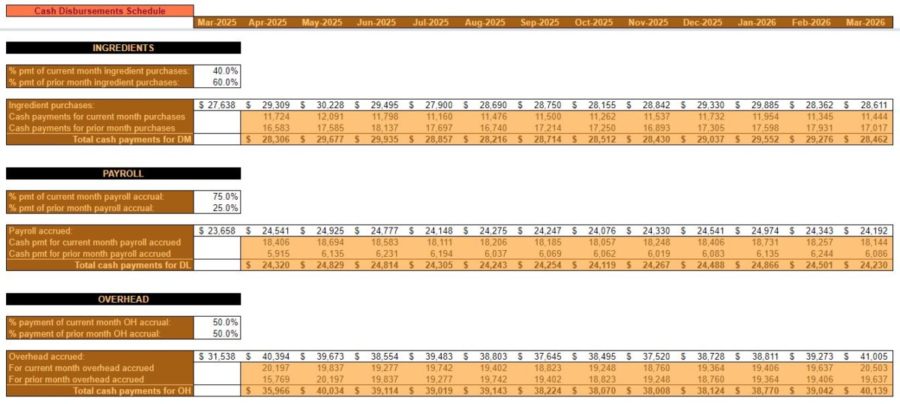

Also, though I don’t advocate for pricing strictly on the basis of costs, it is important to understand your costs so you can be certain that you’ll meet your margin goals. Therefore, this is also an excellent time to make sure your costing is accurate.

What are your competitor’s pricing strategies?

Just as with the USP, you’ll want to reflect upon how your competitors price their products and services.

Think about how their pricing lines up with their USP. Does it make sense? Do you have any competitors that always insist on competing on price? Yes, that can be frustrating. But it also likely means that they don’t have much of a marketing plan.

In turn, maybe you can further distinguish your business while they fall back on the only trick they know – lowering their prices. As a result, your business will strengthen and theirs will weaken.

How will advertising be used in your marketing plan?

Your USP will give your advertising focus. It allows you to deliver a consistent message to prospective customers. The number of avenues that you can use for marketing is almost limitless.

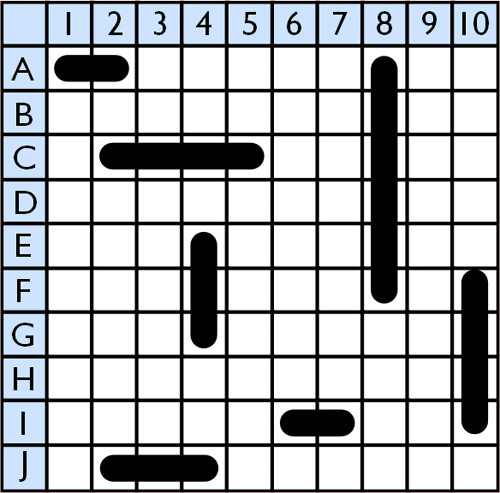

If you’ve been in business for any amount of time, then you probably have some experience with advertising. This is a good time to “play Battleship” – so to speak.

What I mean by “play Battleship” is – think about what’s worked well for your small business, and expand upon that. Once a particular opportunity has been fully exploited, you can change your medium, message, or any other variable until you get another hit.

When you get another hit, only make small tweaks until that opportunity is exploited. And so on…

Don’t let your marketing stray too far from your target market, however. Your entire business is built around your target market. A target market can grow or change over time, but that’s a longer-term undertaking. Advertising can be more flexible and nimble.

A thorough analysis is worthwhile here. While, yes, there is such a thing as branding and it has its value, advertising should provide you with a good (and quick) return on investment. Hold your advertising, and yourself, to high standards. Advertising is expensive and you don’t want to be throwing those dollars away.

Analyzing competitive advertising

This might be the easiest part of the marketing plan to analyze what your competition is doing. After all, the point of advertising is to get as many eyes on it as possible.

That being said, it’ll be damn near impossible to know what your competition’s ROI is on their advertising. However, being an expert in your industry, you’ll probably know effective advertising when you see it. So, when it comes time to play Battleship again, you’ll have a good idea of where to start.

How will sales compliment your marketing plan?

Marketing turns people unaware of your product or service into leads and prospects. From there, it’s the responsibility of the sales organization to turn leads and prospects into customers.

Not every business will employ direct salespeople. However, keep in mind that any employee which has contact with customers is a defacto salesperson. Make sure that these people are adequately trained and are not leaving sales on the table.

You can’t fix what you can’t measure. So, be sure that you have the means to measure your conversion rate along the entirety of your funnel. Also, are your people properly incentivized to make sales? Obviously, there’s no law that says you can only pay incentives to salespeople. Paying a commission or a bonus is a variable cost that can have a high return on investment.

Speaking of costs, consider your costs tied to sales. Be wary of fixed costs. With high fixed costs, you’re starting in a hole. You have to reach a certain volume in order to break even.

If you’re confident that high volumes can be achieved, then that could be okay. If you’re not as confident, or your business has a high amount of financial leverage (debt), then you should probably steer clear of high fixed costs.

Performing a competitor sales analysis

Obviously, it’s difficult to know what your competitors’ cost structures are. Do they have heavy fixed costs or mostly variable costs? If they’re a high-volume competitor, hopefully, their costs are mostly variable. Conversely, if they’re low volume, you should hope that their costs are fixed.

You’ll have to work with whatever information you can gather. It’s probably easy enough to discover if they pay their salespeople commission, and how much that commission is. You can probably also get an idea of what kind of sales training they offer.

The point here is to get an idea of where your small business stands in terms of its potential for sales success. You want to balance between being someone that the best salespeople want to work for, and your own bottom line.

What is your distribution strategy?

Making sales is great. But if you can’t get the product to the customer, what’s the point? Not to mention the negative goodwill and customer dissatisfaction that comes with distribution interruptions and delays.

Customers don’t want to give you money just so you can make a hassle for them. They expect your customer service to be such that they don’t have to stress over getting the value that you promised them.

Authenticity, timeliness, and redundancy are the name of the game here. Communicate with your customers clearly, make it a priority to get the product or service in their hands, and have a back-up plan.

Obviously, utilizing the power of the internet opens you up to markets you wouldn’t have otherwise had access to. This is an opportunity that comes with a lot of competition, however. So, if you plan on selling via the internet, you had better specify elsewhere in your marketing plan how you’re going to stand out from the competition.

Finally, don’t forget to factor these distribution costs into your pricing analysis. They’re, more or less, direct costs so they should be easily allocated.

Your competition’s distribution strategy

By now, you get the point. You want to look at what your competition is doing and decide what strengths you should emulate and what weaknesses you should avoid or exploit.

If your competition places some of the burdens of distribution on their customers – that’s something that you want to highlight in your sales, advertising, and promotional efforts. That is, assuming, that you don’t do the same.

Also, if you can put a distribution strategy in place that opens up a larger market than your competitors, then the likelihood that you can better them will increase significantly.

How do I write a marketing plan?

Hopefully, clarifying your unique selling proposition and fine-tuning your pricing will lay the groundwork for your advertising, sales, and distribution to be successful. Additionally, by keeping a close eye on your competitors’ marketing strategy, you can put your small business in a position to gain market share. Hell, you might even know their marketing strategy better than they do by the time you’re finished.

What this should translate into, is the maximization of sales and revenue for the coming year. That, along with effective cash management, will put you in a position to not only grow your small business’s earnings but to also take advantage of any other opportunities that present themselves.