Video transcript

00:00 QuickBooks Online credit memos ensuring

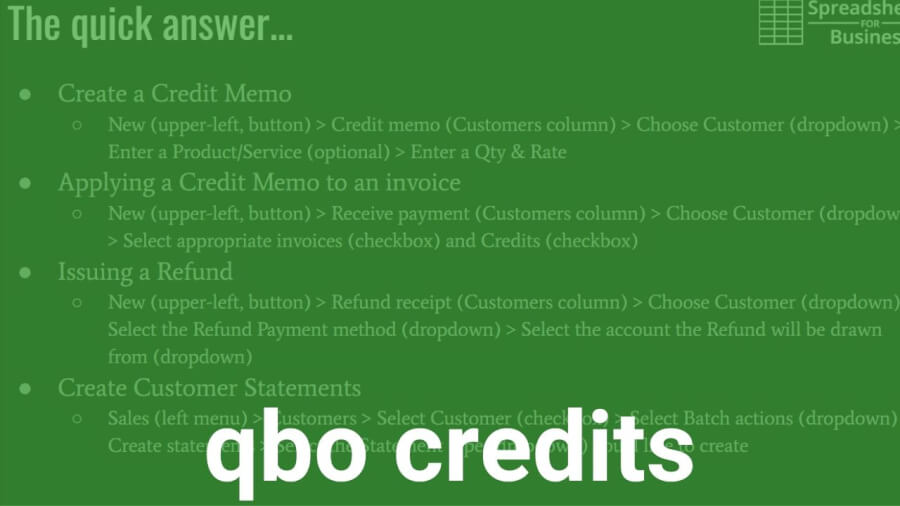

00:02 accurate reporting okay so I let’s start

00:06 off your video off with a quick answer

00:08 so that somebody just needs to know

00:11 where to navigate to can get the

00:14 information they need the as you can see

00:17 there’s kind of a lot of aspects a lot

00:20 of quick answers to this video I will

00:21 start with the most fundamental which is

00:23 how to actually create a credit memo

00:24 okay and that’s easy enough that it is

00:28 done by going up to the new button and

00:30 under the customers heading you’re gonna

00:33 click on credit memo okay so once you

00:36 have a credit memo in there so you want

00:38 to apply that credit memo to an invoice

00:40 for a customer that’s new receipt

00:44 payment and enter the pertinent

00:56 information there back you out okay say

01:06 that you’re not able to do that ideal

01:09 thing where it makes more sense to issue

01:11 a refund rather than a credit memo you

01:14 can do that also in the new button and

01:17 hit refund receipt under the customers

01:21 column

01:34 and you’ll select the amount of the

01:36 refund there and fill out all the other

01:38 pertinent information about the customer

01:40 and then finally the customer request

01:43 statement or if you send out statements

01:45 as a matter of procedure then that’s

01:49 going to be a little different area

01:50 that’s gonna be the sales menu and

01:53 customers and you’re gonna select a

01:55 customer those sales customers okay you

02:01 just select the customer and batch

02:04 actions it’s a little tough to say and

02:07 create statements pick your statement

02:11 type your date range and send it the

02:15 customer okay so that’s it for the quick

02:19 answer now I’m gonna get into a little

02:22 more detail there’s a lot to cover here

02:25 so we’ll start plugging away okay so

02:32 first of all what our credit memos

02:35 excuse me

02:37 credit mine was the ability to credit a

02:38 customer for a particular dollar amount

02:41 next time that they receive an invoice

02:43 the credit will reduce the amount that

02:45 they owe it’s not a refund not the same

02:49 thing similar in nature but not the same

02:52 cash does not go back to the customer

02:55 which all things being equal is good you

02:58 don’t want cash leaving a business if

03:00 you can help it

03:01 it can be reflected on a customer

03:03 statement of course and should be and

03:06 will reduce the amount of accounts

03:10 receivable that you have once you’ve

03:12 created a credit memo okay so why use

03:14 them you know changing a transaction

03:19 like a past transaction can create

03:23 confusion you know if you’re tweaking

03:26 the amount that you sold it for or start

03:29 fidgeting around with you know standard

03:32 prices and and that sort of thing you

03:35 might not know the details of why you’re

03:38 doing what you’re doing so you know your

03:40 books could become out of balance if the

03:42 transaction was in a previous period too

03:44 so you know in simply discounting the

03:49 next transaction along the same lines

03:51 isn’t gonna tell the whole story you can

03:53 look back a year from now two years you

03:56 know you could send out a statement to

03:57 the customer they weren’t clear about

03:59 what happened and you don’t remember if

04:01 you deal with a lot of customers a lot

04:03 of transactions or somebody else in your

04:05 organization did it or you didn’t do a

04:08 credit memo but edit a transaction it

04:10 just can create confusion so you know a

04:13 credit memo accurately portrays the

04:15 events that took place okay it creates

04:17 what they call an audit trail it you

04:21 know allows you to look at it and

04:26 basically do what I out on this channel

04:30 is to make sure your accounting system

04:33 matches reality you know so it’s

04:37 beneficial in those terms and you know

04:43 really the the correct the best practice

04:46 so to speak when it comes to giving a

04:48 customer credit you know and a credit

04:51 memo is preferable to a cache where you

04:53 fund all things being equal sometimes

04:55 you’ll have to do a refund perhaps but

04:58 you know the reason for that is because

05:00 the old finance or basically what

05:03 corporate finance is built on a dollar

05:05 today is worth more than a dollar

05:06 tomorrow you want to keep that cash in

05:08 the organization so you can use it so

05:10 you can use it to pay employees so you

05:11 can use it to pay vendors okay so you

05:14 can reinvest it in your business and if

05:16 you send cash out to the customer

05:19 there’s no guarantee that they’re going

05:20 to return with that cash okay if if you

05:23 can get away with using a credit memo as

05:25 opposed to a refund then it incentivizes

05:27 them to come back their next purchase is

05:30 going to be less it’s going to have a

05:33 credit applied so you know it’s that’s a

05:37 couple of the reasons that a credit memo

05:39 is preferable to a cash refund with

05:43 QuickBooks Online it can be applied

05:45 automatically this is something you

05:47 specify in accounts and settings to

05:51 automatically when you create a credit

05:53 memo to apply to next invoice but yet

05:56 like I said you have to turn that

05:57 setting on

05:59 so we’ll get in a little more detail

06:02 rather than a quick answer rushing

06:04 through how to create a credit memo

06:09 again you’re gonna go to the upper left

06:14 do new button bit credit memo will

06:19 appear under customers credit memo and

06:25 then you’re gonna pick your customer

06:26 that’s going to receive the credit memo

06:32 will use won’t Duke’s basketball camp

06:36 again so you need to specify what the

06:45 credit memo was for if it’s you have to

06:50 use your judgment here if it’s in

06:52 regards to something being miss you know

06:59 something wrong on the invoice to the

07:01 customer or something an error involving

07:05 a particular product or service you can

07:06 select that particular product or

07:08 service and edit the quantity and/or

07:10 rate rate over to the right here or

07:15 potentially you could create a non

07:17 inventory product or service and

07:22 basically edit the description to say

07:25 this is a credit for you know the

07:31 customer was upset about the customer

07:33 service or something or whatever the

07:34 reason may be you know just so again so

07:37 you’ve got something a thorough

07:39 description there so you know when you

07:41 look at it years from now what you did

07:43 this for so maybe we miss billed if

07:50 that’s even a term build an error for a

07:56 rock fountain to Duke’s basketball camp

07:59 and we want to issue a credit memo for

08:03 $275 08:10 okay so we enter that information

08:14 product or service it is optional you

08:16 can just enter a quantity or rate also

08:19 and then you’re gonna hit save and new

08:23 if you want to do another you have a

08:25 couple credit memo standard Savin San to

08:27 email them the credit memo or just save

08:30 and close to exit in this case you can

08:33 preview it if you’re sending it to the

08:34 customer and you know actually let’s do

08:38 this let’s just delete this and let’s

08:44 just say we’re going to credit the

08:45 customer $275 they’re no product just we

08:49 messed up here’s our credit for $275

08:56 okay so that got sent to the customer

09:00 this is a sample company so didn’t

09:02 really send it to anybody but now it’s

09:05 in a system for Dukes basketball camp

09:08 okay so you expanse of all camp comes

09:11 back to us for more landscaping services

09:13 that’s our sample company that’s the

09:15 business they’re in and we’re gonna play

09:18 that credit to the next invoice so have

09:21 to have an existing invoice to credit of

09:23 course and it’s only necessary if

09:27 automatically applied credits like I

09:29 mentioned and account settings isn’t

09:31 selected and to do so you go to new the

09:35 upper left button receive payment and

09:44 hopefully there’s a default invoice in

09:46 here for Dukes basketball camp let’s see

09:56 doesn’t have an open invoice okay so I

10:00 picked the wrong customer there let’s go

10:03 with Geeta okay

10:06 so we’re gonna select we chose this

10:12 customer we’re gonna select the

10:13 appropriate invoice with a checkbox and

10:15 then there we go and then down below

10:24 here we would have a credit section that

10:30 we could apply to Gita’s let’s back out

10:36 of here and do it the right way

10:39 new credit memo and let’s apply it for a

10:51 friend eat it

10:57 let’s see I’m just doing them out here

11:03 over the 275 there okay now we have a

11:17 credit memo and forget it – now we will

11:25 go to new receive payment we know Geeta

11:30 has at $623 employees has standings

11:33 there I’m

11:45 is that and actually in this case they

11:51 are automatically applied

11:53 so you’ll notice the original amount 629

11:55 I misspoke but here’s the balance

11:58 at $275 doesn’t itemized it here but

12:02 you can see that it did apply it on the

12:06 next invoice if it’s not automatically

12:10 applied like I said it’ll appear down

12:11 here below where you can select the

12:12 credits that you want to apply to credit

12:14 memos to the invoices you’ve selected so

12:18 when we applied that save and send to

12:22 Geetha and hopefully it will show

12:26 applied on her PDF here no it doesn’t

12:36 that’s a little bit of a shortcoming a

12:37 little more detail would be good there

12:39 but what’s important is Geetha gutter

12:43 credit

12:44 okay so Geetha is a happy customer once

12:46 warm and you know we go back about our

12:50 business

12:52 so issuing a refund now let’s say Geetha

12:56 said no I’m never doing business with

12:57 you again I’m outraged you know it’s a

13:01 bad situation

13:02 I want to refund okay then to issue a

13:06 refund again to new we’re gonna go to

13:08 refund receipt this time the customers

13:10 column we’re gonna choose Geetha from

13:13 the drop-down customers refund receipt

13:28 choose geet okay and we want to choose a

13:38 refund payment method okay we’re gonna

13:41 do cash we’re gonna do credit back on

13:44 our credit card will do check for Geeta

13:52 and where it’s coming from want to

13:57 select that and we want to enter an

13:59 amount to that $75 and hopefully that’s

14:06 it for the refunds were issuing so we’ll

14:08 hit save and close and Geeta

14:14 there goes refund issued $275 okay now

14:22 it’s getting a little more detail about

14:25 statements statements provide

14:28 transparency to customers about their

14:30 account standing about the details of

14:32 credits refunds and that sort of thing

14:33 unfortunately the the receipt that we

14:37 issued early to get it didn’t I mean she

14:40 would probably know but it didn’t say

14:42 you know hey and you know and this is

14:44 just a preference of mine I want to know

14:46 here’s what it was you know the cost of

14:51 what I purchased from you here’s what

14:52 the amount it was this kind of buy is

14:55 and here’s the net amount that I would

14:57 owe and you know and I paid and here’s

15:00 my receipt detailing all that I didn’t

15:04 do that but the detail should be on the

15:06 statement so how to create a customer

15:11 statement it’s time again we don’t go to

15:14 new button we go to the sales menu with

15:18 select customers and we are already here

15:20 so sales customers that’s where we are

15:22 now okay then I’m gonna check box for

15:26 let’s look at eat as a count here for

15:29 the customer we want and you can do this

15:34 as in batch so you can do what have you

15:36 select here for all customers in this

15:37 case we’re just doing Geeta

15:38 she says send me stay Milan I’ll make

15:41 sure everything’s right about what you

15:43 did with my account okay eat him happy

15:46 to do that and we select that batch out

15:52 actions drop-down and create statements

15:55 okay so we want to select the statement

15:58 type that we’d like to create we’ll get

16:00 into that in a little more detail here

16:03 in just second we want whichever is most

16:05 appropriate for the situation with the

16:07 date range we’ll give her for the past

16:09 month here and yeah so let’s talk about

16:14 statement types real quick before we do

16:16 that

16:16 okay balance for word is gonna give a

16:18 list of payments and invoices that the

16:20 customer had it clarifies what is

16:22 currently do on the account open items

16:26 okay this is gonna be open invoices

16:28 detail and unpaid invoices credit memos

16:31 and unapplied payments this would have

16:33 been the type of statement we would have

16:35 santaguida before we did the settled the

16:42 invoice earlier well actually that one

16:48 might I guess since we just sent the

16:50 invoice then one might be appropriate

16:51 trans actually same it’s gonna be

16:52 transaction detail of a date range it’s

16:54 appropriate for accounts with a high

16:55 volume of transaction so let’s try this

16:56 open item here and apply it now nothing

17:08 trade balance forward then

17:20 all right because Gita’s balance is zero

17:23 now so let’s do save and send this is

17:29 what’s nice about QuickBooks Online it

17:30 gives you the opportunity to preview it

17:32 yeah this is what we want okay so not a

17:35 high volume in transactions but

17:37 specifies what we did on the account you

17:42 know we issued an invoice on 12:12 for

17:45 six hundred twenty nine ten dollars

17:47 there’s our credit memo we entered

17:49 earlier for 275 there’s a refund

17:52 we gave her for 275 obviously in the

17:54 real world you probably wouldn’t do both

17:56 but you know Gaeta was our best example

17:59 so now Gaeta owes us seventy nine ten

18:04 we’ll send that to her and there you go

18:10 okay

18:12 so have you previously created

18:13 statements and like I said there’s a lot

18:16 of detail on this one but we’re almost

18:18 through it sales on the Left menu with

18:22 all sales sales all sales we’ll just

18:26 click it here takes us to the same spot

18:32 from there we’re gonna select the filter

18:35 drop down and type statements so we want

18:41 to filter and type so drop down drop

18:45 down statements okay for the last year

18:52 well let’s apply that should show Geetha

18:54 is I think yes there it is so now we can

18:58 see it again if she calls in with a

18:59 question about her statement you know

19:02 again this isn’t all gonna happen just

19:05 boom boom boom like we’re doing it now

19:06 you know time will pass people forget

19:09 stuff you know you got a lot on your

19:11 plate as a small business owner so you

19:15 know this is how we can see again

19:17 Geeta’s a statement and she wants to

19:20 call him and speak on it then we’ll have

19:22 it in front of us and we can help her

19:24 piece together what happened so

19:29 that’s the view previously created

19:31 statements now to automatically apply

19:34 credits which is what was set up in this

19:39 particular sample account but just to

19:42 let you know how that happened

19:43 I’m gonna go to the gear in the upper

19:45 right accounts and settings under the

19:48 your company heading your company

19:54 accounts and settings then on the Left

19:57 menu we’re gonna go to advanced and

19:58 we’re going to edit and edit click the

20:01 little pencil any automation section

20:07 waiting on it here ok let’s try again

20:14 counts and settings let’s do advanced

20:21 and like I said down here in the scroll

20:26 post-it no advanced ok in in the

20:40 automation section edit and that’s check

20:47 box you’re looking for automatically

20:49 applying credits is on off set of how

20:53 you want it probably on and then you

21:01 want to click Save now will

21:03 automatically applying credits then

21:06 click done to get out of the accounts

21:08 and settings okay so that covers

21:13 everything to do with credit memos so a

21:19 lot of information there but covered

21:21 credit memos refunds statements you know

21:26 so everything kind of potentially

21:29 affected by a credit memo so there’s a

21:31 lot to you know there QuickBooks Online

21:35 is pretty simple but there’s a lot of

21:37 different a lot of things you can do you

21:40 know because business is dynamic and

21:41 you know that you know so if bookkeeping

21:46 isn’t your cup of tea if you know having

21:49 to research and how to do this stuff

21:51 every time you need to do something new

21:52 there’s a new cup of tea if you’d rather

21:54 spend your time working on your business

21:56 helping it grow and less time on menial

21:59 tasks like watching spreadsheets for

22:01 business quickbooks online videos

22:03 nothing personal I get it and you know

22:07 you just want to do more business and

22:09 less data entry okay then check out bot

22:11 keeper I’ll have a link down in the

22:12 description and what bot keeper does is

22:15 automate but keeping tasks that you hate

22:17 to do all right so it’s a artificial

22:21 intelligence powered and that’s what

22:24 does the bulk of the work and then it

22:27 also has a human touch that kind of

22:29 qualifies the artificial intelligence

22:32 transactions and you know just puts a

22:35 set of human eyes on it to to make sure

22:37 everything’s accurate timely and you

22:41 know most importantly off your back so

22:42 if it’s something you think you’d be

22:44 interested in again click that link down

22:46 in the description and check it out so

22:48 this was a long video I’ll wrap it up

22:51 here thank you for liking and

22:53 subscribing and why would you like well

22:56 if you liked the fact that I got gave it

22:59 a quick answer up front was shortened to

23:00 the point but then went into more detail

23:02 after that if you’d like that format I

23:03 would appreciate a like if you find

23:05 yourself if you’re gonna do your own

23:07 bookkeeping and you find yourself

23:08 looking up how to videos and QuickBooks

23:11 Online fairly often then consider

23:14 subscribing so you can just jump onto my

23:17 channel and see if I’ve covered it and

23:19 in that case great then if not you can

23:22 search search it on the YouTube you know

23:27 through the youtube search so hey I’m

23:30 appreciate you guys watching as always

23:32 take care