FIFO is a method of valuing inventory and cost of goods sold (COGS).

FIFO is an acronym for First In, First Out. With the FIFO method, the assumption is made that the first products purchased (put into inventory) are the first to be sold (taken out of inventory). Note that this is only an assumption. If you use the FIFO method it doesn’t mean that you really have to physically sell the oldest pieces of inventory you have in stock.

There are many other methods of inventory valuation. One of those is LIFO. As you might have guessed, LIFO stands for Last In, First Out. Another is weighted-average cost.

Why use the FIFO method for inventory valuation?

The FIFO method is often used because of its simplicity. It is also used because it gives a more accurate representation of inventory and COGS balances.

If costs are rising, as they often do, the FIFO method is also going to allow your small business to report greater profits. Because, it’s the older, cheaper, inventory that will be moved to COGS first.

Also, not that it matters much to your typical small business, but many countries outside of the United States are required to use FIFO by International Financial Reporting Standards (IFRS). The FIFO method is widely used and widely understood.

Why use a different method than FIFO?

FIFO has its advantages, as outlined above. But, it also has some disadvantages. Or, at the very least, some characteristics that make FIFO less appealing than other valuation systems.

Just as FIFO makes net income look bigger when costs are rising, it will also make it smaller when costs are falling. Falling costs are rare, but it does happen.

Plus, keep in mind that a higher net income also results in higher taxes. But, a higher profit will probably make your business more appealing if you were to decide to sell. So, it’s kind of a double-edged sword.

Beware, however, if costs are rising really fast. In circumstances such as these, you might run the risk of overstating profit using the FIFO method.

Also, while calculating FIFO balances is typically easier than LIFO, it’s not necessarily as simple as a standard costing system.

How is FIFO calculated?

To value inventory and COGS using the FIFO method you (or more likely your software) will need to keep track of something called costs tiers.

Every time you purchase (or manufacture) a specific quantity of inventory, at a specific cost – a cost tier is created.

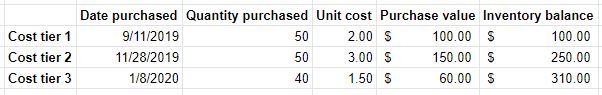

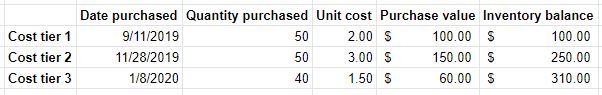

Here is an example of three distinct cost tiers. Notice how each has a different Date purchased, Quantity purchased, and Unit cost.

Purchase value = Quantity purchased × Unit cost

Inventory balance = running total of Purchase value

As inventory is sold (or used in production) it is the oldest (First In) tiers that are relieved first (First Out).

This means that the cost you paid for the oldest inventory is what moves to COGS. The value of the more recently purchased products is what will remain in inventory. Of course, if you sell all of the products you have in stock, nothing will remain in inventory.

Next time you sell (consume) this product, the next oldest inventory will move to COGS. And on and on it goes while costing with the FIFO method.

FIFO method example

For this example we’ll use the same cost tiers from the image above.

On September 11, you bought 50 units of a product. You spent $2.00 dollars each. That’s your first Cost tier.

Then, on November 28, you purchased another 50 units at $3.00 each. That would be Cost tier 2.

Finally, on January 8, you purchased 40 more units at $1.50 each. Cost tier 3.

We’ll assume that you didn’t sell any of this product between September 11 and January 8.

So, you now have 140 units in stock at a total cost of $310.00. This total cost is comprised of three Cost tiers.

Your average cost is $2.21 each ($310.00 ÷ 140 units). Your first units were purchased at $2.00 each. Your last units were purchased at $1.50 each.

Now, let’s assume that you sell (use) 75 units out of inventory. What are those 75 units going to cost each?

$2.21? No. That’s the average cost.

$2.20? No. That’s LIFO.

(40 × $1.50 = $60

35 × $3.00 = $105

$105 + $60 = $165

$165 ÷ 75 = $2.20)

$2.33? Yes. That’s the cost using the FIFO method.

(50 × $2.00 = $100

25 × $3.00 = $75

$100 + $75 = $175

$175 ÷ 75 = $2.33)

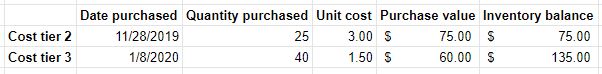

In order to calculate your COGS with the FIFO method, you’re going to start with the oldest (First In) cost tier. That cost tier has 50 units at a cost of $2.00 each.

Since 75 units were sold, that leaves 25 more to account for. Of course, those units will come from the next oldest cost tier. That cost tier has a Unit cost of $3.00 each.

So, we know that 50 of the units cost $2.00 each and that 25 of the units cost $3.00 each. This means that the total COGS is $175 and the cost per unit is $2.33.

Not too hard, right?

But, where’s that leave inventory?

With Cost tier 1 depleted and Cost tier 2 relieved of 25 units, the inventory balance is calculated as follows:

Cost tier 3 remains untouched. Cost tier 2 only has 25 units left in it.

The total value of inventory is now $135. Of the original $310 in inventory, $175 of it was sold (via the FIFO method) and $135 remains.

That’s it! This is what happens when you use the FIFO method for inventory and COGS valuation. Once you understand the basic principles, hopefully you’ll see that it is pretty simple and straightforward. It facilitates logical and consistent valuation of inventory for your small business.