Download the restaurant spreadsheets

What is considered inventory for a restaurant? Video summary

Inventory information is only useful if it contains critical data. Having access to your restaurant’s most important information will help you make smart decisions for your restaurant.

Actual inventory levels must be consistently physically counted and compared to amounts listed in the software. Corrections in the software must be made if there is a discrepancy.

Many restaurant software tools will help to keep track of inventory. However, if they don’t, you can’t neglect this task. Even if they do, periodic inventory counts are still necessary.

What should a restaurant inventory list look like?

There are five fields that are critical for a restaurant inventory list.

These fields are:

- Item

- The name of what’s being counted

- Unit of measure (UOM)

- A consistent quantity that will be used for counting and costing

- Quantity on hand (QOH)

- How many UOM the restaurant currently owns

- Item cost

- Don’t count in one UOM and cost in another

- Extended cost

- QOH × Item cost

- The total value of the inventory

Additionally, you can include other fields in your restaurant inventory list if appropriate. For example:

- Category

- Meat, vegetables, raw, prepared, etc.

- Location

- If you have more than one

- Any other classification that helps you manage inventory

The restaurant inventory list

Fill out the critical fields for every item you own. If you must, it is okay to use multiple lines for the same item. The pivot table functionality of the spreadsheet can handle it.

Your restaurant’s POS (and other types of) software might be able to help with inventory management. It depends on the software functionality. Some software will track inventory usage. Your accounting software might track purchases too and may keep running inventory levels.

Not every piece of software will keep track of waste, spoilage, and other losses, however. Therefore…

Cycle counting of restaurant inventory will still always be necessary. This ensures that your inventory counts are accurate and you can meet demand and avoid waste.

Employees play an important part in inventory management. Consider giving them an incentive for accurate inventory counts. Explain to them the importance of accuracy.

When cycle counting – maintain a consistent schedule and stick to it! Inventory items with high turnover should be counted more frequently.

Finally, remember to track waste and food loss. Particularly if your software does not. During the hustle bustle of the workday, it may not be possible to accurately measure wasted quantities. Do your best to estimate them. Inventory amounts will be accurately adjusted next cycle count.

Utilize the Food Waste spreadsheet on the Why Spreadsheets Are Your Restaurant’s Best Friend workbook (download above). Also, take advantage of the other spreadsheets in the workbook including:

- Scheduling template

- Vendor order sheet

- Daily prep list

- Inventory control

- Food/recipe costing

- Food waste

- Sales per day

More considerations regarding your restaurant inventory list

Only consumable items that you use to prepare food should be included in your inventory. Not every asset should be included here. Things such as flatware, cookware, glassware, etc. are not inventory.

It’s important to keep accurate records for these assets, but they are not inventory. Inventory is what you sell to your customers.

Again, make sure you’re using a consistent UOM for your inventory items. Use whatever is easiest to track. Whether it be Lbs, Gal, Oz, Cans, Cases, Flats, whatever – just stay consistent. Doing so will ensure that costly errors in counts and valuation aren’t made.

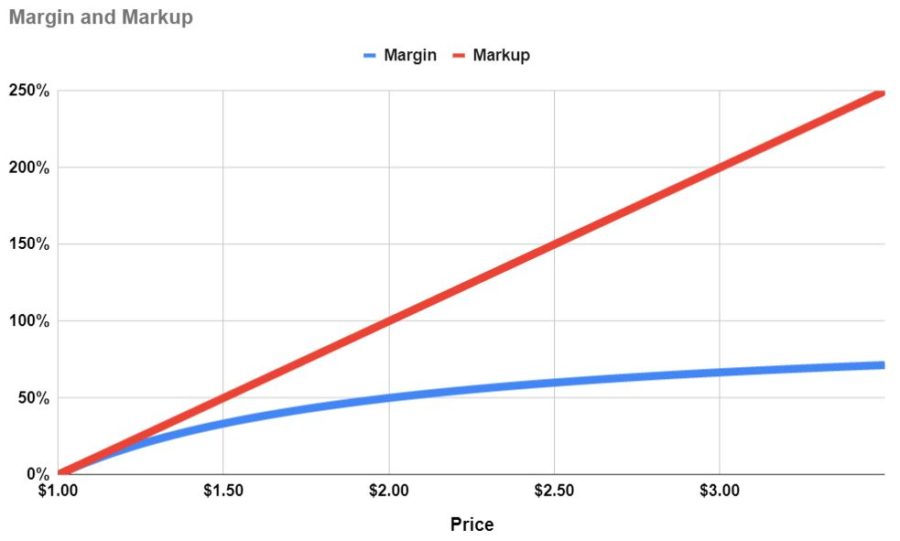

Food costs are rapidly changing. So what cost should you use?

Your POS or accounting system might track costs for you. If so, great. If not, it might make sense to assign a standard (expected) or average cost to inventory items.

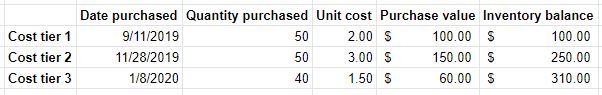

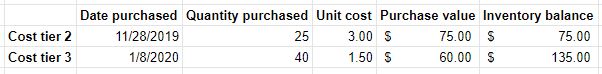

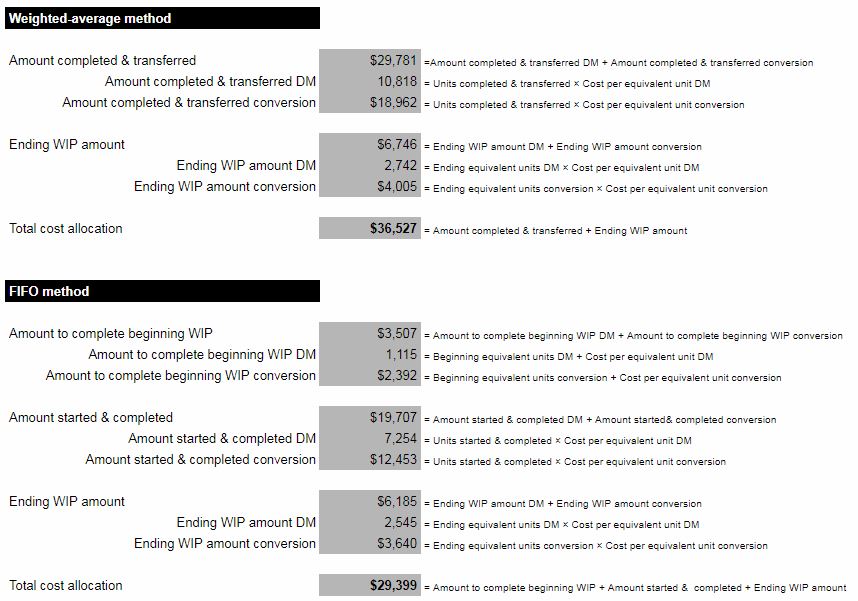

No matter what inventory cost you use, make sure you’re relieving inventory on a First In, First Out (FIFO) basis. E.g. use your oldest inventory first, assuming it’s fit for consumption, of course. No other industry has to wrestle with the issue of spoilage more than the restaurant industry. So, do what you can to avoid needless waste of inventory and dollars.

Again, at the risk of beating a dead horse, make sure your costs reflect your UOM.

Finally, one of the primary benefits of managing your restaurant inventory is that you can measure inventory days on hand. In order to do so, you must keep track of inventory usage on a daily basis.

Inventory days on hand = inventory on hand ÷ average daily usage. Assuming that you are meeting all of your customer’s demand (not running out of stock) then the lower your inventory days on hand, the better.

Questions about How Do I Make a Restaurant Inventory List?

What challenges do restaurants have with managing inventory?

Spoilage is one inventory problem that the restaurant industry is particularly prone to. Many inventory items, by necessity, have an extremely short shelf life.

Accountability is another. With so many different individuals handling and recording inventory, it can be difficult to ensure that QOH in your software matches reality.

Finally, running out of inventory can hurt customer service for a restaurant more than it can other industries. While other businesses can put an item on backorder for a customer – restaurants can not.

These are just a few. There are many more unique challenges that restaurants face in managing inventory.

How does one manage quality control and inventory control smartly in a restaurant for an owner who lives in another city?

Most importantly, it is critical to find employees that can be trusted to manage inventory smartly. Also, while you want every employee to use best practices when it comes to inventory management, you’ll probably want to have one trusted individual who will have ultimate accountability.

Which is the best software for inventory control in a restaurant?

There are a lot of options out there. However, a piece of software called Restaurant 365 seems to be pretty well regarded. I’ve never used it myself. So, I can’t attest to its quality. In my brief searching, though, I never saw any negative feedback. Pricing will run from $250 to more than $450 per month per location.

Spreadsheets are also often recommended. They take some work to get set up, but one major benefit is the ability to customize them to your needs. Feel free to download the inventory control spreadsheet above and check out the Why Spreadsheets Are Your Restaurant’s Best Friend post and video.