“How useful is a cash flow forecast to a small business?” Even a simple, short-term, cash flow forecast can help a small business avoid insolvency. By seeing potential cash flow issues weeks in advance, strategies can be utilized that will allow you to be proactive and help ensure your small business’s survival.

Small business cash flow planning involves calculating the effects of future inflows and outflows. Doing so will allow your small business to plan for problems. Then you can take control of them before they spiral out of control. Below, you can download an easy-to-use spreadsheet to manage your small business’s short-term cash flow.

Most small businesses aren’t “cash cows.” Even the most prudent small business owner can occasionally run into circumstances where cash is flowing out faster than it’s coming in.

Yes, you’re busy running the operations of your business. Maybe you’ve handed the reins of the accounting and finance functions to someone else. But, you’re the owner. You have to ensure that you have the cash available to fill your short-term obligations

Download a simple small business cash flow template

This site is called Spreadsheets for Business, so this post wouldn’t be complete without an accompanying cash flow template.

Complete the form below and click Submit.

Upon email confirmation, the workbook will open in a new tab.

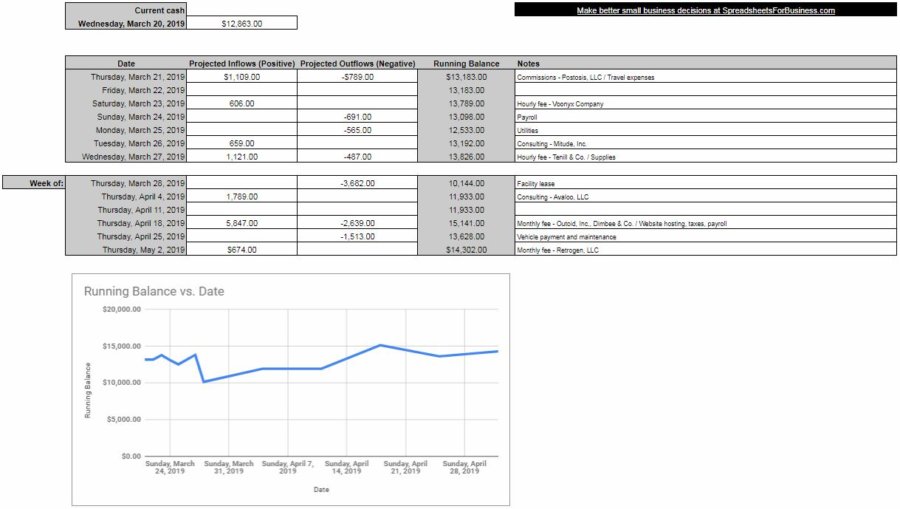

This is a really simple template and it doesn’t require too much in the way of input. As with all other Spreadsheets for Business workbooks, the white cells are the ones that you fill in. The colored cells (gray in this case) have formulas and text in them.

The example data illustrates how the template works. It is for a hypothetical bookkeeping company that has revenue in the form of commissions, hourly fees, monthly fees, and consulting. It also has your typical small business expenses including things such as travel, leases, payroll, and utilities

A quick how-to on this spreadsheet

First of all, delete the example data out of the white cells. Then in cell D3, enter your business’s Current cash Balance.

Next, move down and fill in projected cash inflows and projected cash outflows for each day in the upcoming week. This is done in cells D7 through E13. Remember to enter inflows as positive, and outflows as negative. The Running Balance will update automatically.

For each inflow and/or outflow you enter, you have the option of typing a quick note to explain the transactions taking place.

After you’re done entering cash inflows and cash outflows for the coming week, move below and enter them for the upcoming six weeks. Just as above, notes can be entered to elaborate on the weekly inflows and outflows.

Finally, a simple chart is included at the bottom to illustrate the changing cash balance over the next seven weeks.

It might be that your accounting software already does something similar for you. Perhaps it’s even more robust in its analysis? However, if your accounting software doesn’t do such a thing; or if you don’t know how to use it – this simple template will give you the opportunity to think critically (even if only briefly) about this important aspect of your business.

What is small business cash flow projection?

Cash flow projection means looking into the future. Taking what you know, plus what you guess, to monitor your cash balance.

Some expenses, and possibly some sales, you know are going to flow in or out of your business in a predictable manner. You know what day it’ll happen and you know how much it’ll be.

Other cash inflows or outflows might not be as predictable. An unexpected inflow might come your way, and it’d be a very positive thing. On the other hand, you’ve almost certainly had a situation where a large unexpected outflow is necessary. That’s not quite as positive.

Cash outflows, as I’m sure you’re aware, aren’t all negative, however. Ideally, all of the cash that leaves your business is an investment, of sorts. That investment might be in an employee, it might be in inventory, it might be in an asset, or it might be in anything else that helps you create value for your customers. In other words, something that brings in bigger future inflows.

How sophisticated does cash flow forecasting need to be?

The act of projecting your business’s cash flow can be simple or complex. You can use sophisticated software; or a piece of paper and a pencil. What’s important is that you take the time to perform this important task – not necessarily how you perform it

If you like to approach things from a simplistic standpoint, then that’s what you should do. On the other hand, if you enjoy diving into the details, then there’s really no limit to how in-depth you can go with your analysis.

When you forecast your small business’s cash flow, you can forecast no further than tomorrow; or you can forecast 10 years into the future. The closer to the present you forecast, the more likely your forecast is to be accurate.

A lot can happen in 1 year; not to mention 10 years. So, if you do decide to forecast long-term, just keep your expectations realistic. Financial budgeting is a part of strategic planning. By its nature, strategic planning is focused on long-term horizons.

That being said, there’s absolutely no reason that you can’t do extremely short term planning when it comes to cash flow. We’ll call that tactical planning. And, tactical cash flow planning could be critical to your small business’s success.

Why should your small business manage cash flow?

A lot of business problems are, of course, caused by costs exceeding revenue. Beyond that, however, it’s the timing of cash flow in and out that is the real root of the problem. Once you come up short on cash to pay your vendors/suppliers, pay your employees, or pay for your other assets, it’s easy to picture how this could start a downward spiral from which your small business can’t escape.

The best time to start managing your cash flow is when you started your business. The next best time is right now

Just committing a little bit of time, and performing a simplistic analysis is better than nothing. However, with the tools available on SpreadsheetsForBusiness.com and from other bloggers or software providers, this seemingly frustrating task can be made manageable.

By taking ownership of the things you can control, you put yourself in a position to better handle circumstances out of your control.

Tactics for managing cash flow

Forecasting into the future, even if it’s only a few days or weeks, puts your cash flow situation into perspective. With this perspective, you should be able to better understand what you can control. You very well might not be able to change the amounts of cash outflow. But, you might be able to change their timing. For instance, can you push an expense back (even just a few days) in order to have it better coincide with a cash inflow?

Conversely, if you see that you’re going to run up against a cash flow crunch in the not-too-distant future, maybe you can make efforts to upsell current customers? Or, maybe you can make a push to find new customers? Doing these sorts of things might bring in cash flow and keep your checking account in the black

Likewise, if you forecast cash inflow coming in the near future that you really need sooner, perhaps you can reach out to a customer and ask if they can pay a portion in advance? Maybe it even makes sense to offer a small discount if they do so in order to be able to avoid the threat of insolvency.

Cash flow crunches don’t just happen over the course of days though. They can be a long time coming. So, don’t limit your analysis to the very short-term.

I recommend that you also look out over the course of the coming year and walk through the steps of my small business financial budgeting workbook. It accomplishes the same things as mentioned above, except it allows you to take a couple of steps further back to look at an even bigger picture. The benefits are the same, however. You’ll be armed with the proper perspective in order to be proactive in addressing potential problems for your business.

Every business and industry is different. There is no one-size-fits-all advice for tweaking your cash flow. What I want to make clear though, is that willingly or unwillingly turning a blind eye to what the future holds for your cash flow puts you in a position where you can’t do anything. By simply taking the time to look at the future, you’re empowering yourself to be able to take some sort of control.

Check out 13 tried and true cash management techniques here.

How useful is a cash flow forecast for a small business?

Remember, a more sophisticated analysis can provide you with better answers. But, the bulk of the benefit comes from simply thinking through the subject at hand and taking proactive steps to avoid problems.

If you want to really get serious about your cash flow management, then also check out the Spreadsheets for Business financial budgeting post and downloadable template. It is way more in-depth than this and allows you to plan out over the course of an entire year.