“What is the management of cash flow?” Cash management means not only having enough cash on hand to stay solvent but also having enough cash to take advantage of opportunities as they arise.

Cash management can be done in a number of ways. First and foremost, by collecting cash from customers as fast as possible and paying suppliers/vendors as slow as possible.

Also, consider other tactics including using a revolving line of credit, incorporating subscription-based billing, and outsourcing.

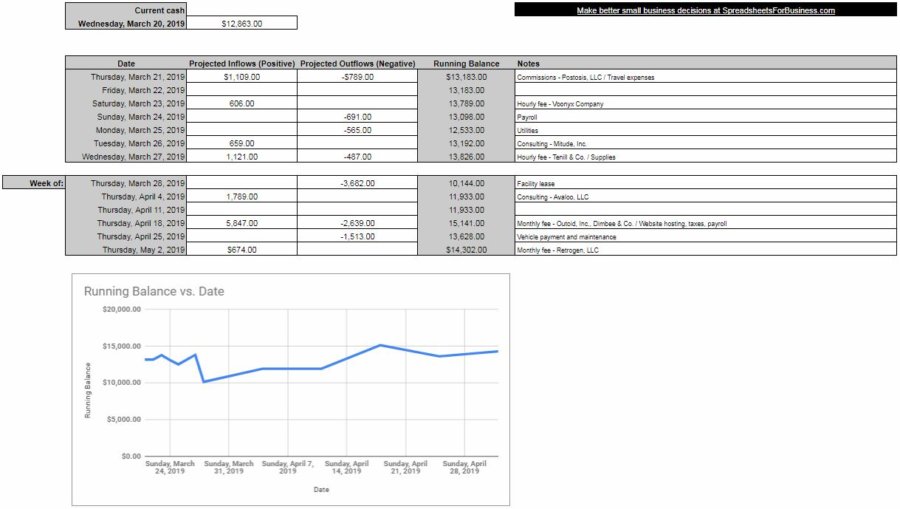

In the previous post on small business cash management, a simple template was provided to allow you to look into the near future and anticipate cash flow issues.

Below, you’ll see some practical techniques that your small business can use to better manage cash flow.

Rather than just giving generic advice, I’ll try to give some industry-specific examples. Hopefully, this will better illustrate how these techniques can help and inspire you to do something similar in your small business.

Uncertainty doesn’t jive with cash flow. For every problem, there is a solution. Maybe not an ideal one but there is something that you can do.

Speed up cash coming in from customers

The quicker you can get cash from customers, the better. All the sales in the world don’t mean anything until that cash hits your checking account. Here are some ways to encourage customers to pay faster.

1) Alter your terms

Offering a discount to customers who pay quickly is nothing new. It’s the reason terms like “1/10, Net 30” exist in the first place.

If you’re not familiar, this means that your customer could take a 1% discount if they paid within 10 days. But, even if they elect not to, the invoice is still due in 30 days. Customers who take advantage of this discount will get you your cash up to 20 days quicker!

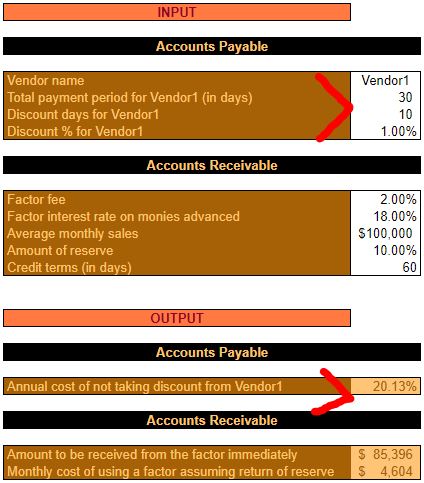

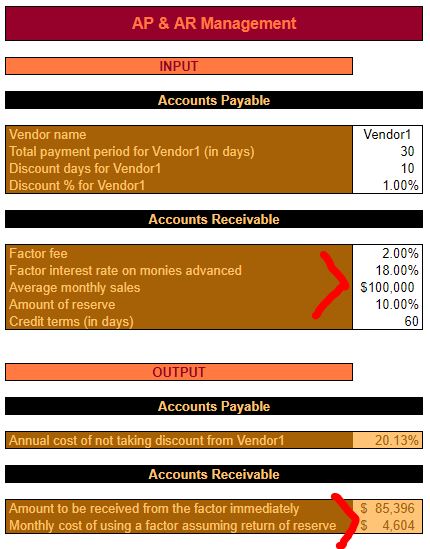

While a 1% (or 2%, or 3%) discount might not sound like much, it can actually add up to a lot. For instance, not taking advantage of the “1/10, Net 30” terms outlined above would cost your customer over 20% on an annualized basis! Be sure to remind them of that!

By the way, the screenshot below is from the Understanding Current Assets & Liabilities With Examples post/workbook.

2) Request a cash down payment

This is a particularly good option if your product or service is higher priced. Or, if it doesn’t make sense to get a cash down payment, can you ask your customer to spread the payments out over the course of delivery? These options are especially helpful if you need to expend a considerable amount of cash to get the ball rolling on the project.

Depending on your industry, this might be kind of a hard sell. But, if the amount of the cash down payment is relatively small, your customer may go for it. You’ll never know if you don’t ask. Plus, if it helps to build a better relationship between you and your customer, perhaps they’ll be more receptive.

Computer Repair LLC’s solution

Computer Repair LLC is finding that they’re not getting paid until up to 45 days after services are performed. This has caused cash flow issues in the past since their lease payment, and many other expenses, are due monthly.

In order to better manage cash flow, Computer Repair LLC first decided to start sending out invoices immediately after services are provided. In the past, they had been waiting up to 2 weeks before invoices were mailed. Since several of their customers only cut checks once or twice a month, there could be a considerable time between when services were performed and when payment was received.

They also started including the words “Due upon receipt” on their invoices. They knew full well that not all customers would pay immediately. But, it was an improvement over their old method of making the due date three weeks after the invoice date.

Also, Computer Repair LLC started offering a small discount for payment received within 10 days or less of the invoice date. This provided an incentive for their clients to pay quickly.

Finally, Computer Repair LLC began to routinely monitor the accounts receivable (AR) aging report built into their accounting software. By monitoring this daily, they were unable to keep an eye on clients that were falling behind. When this happened, they followed up immediately to discuss the situation and make arrangements when necessary.

Slow down cash going out to suppliers/vendors

For the same reason it’s good to get paid fast, it’s good to pay out cash slow. Cash that you pay out is no longer in your control – after all! You don’t want to screw anybody over, of course. But, you want to take any fair advantage you can get. Especially if you’re facing a cash crunch.

3) Cut cash expenses

An expense that is eliminated is one that you can delay forever.

Perhaps you can purchase raw materials for less from a different vendor? Or, can you hire part-time or contract employees before committing to a full-time position?

What about overhead and general and administrative expenses? Things like insurance? Can you negotiate better rates? Is there marketing that you can do that’s just as effective, but cost less? How about leases? Can you re-negotiate them, particularly if times are tough?

Finally, and this is a tough one – can you lower your own salary? Would this work if you could lower your own personal expenses?

4) Alter your supplier terms

Just as you can make changes to your customers’ terms, your vendors can make changes to your terms. That is – if they value your business.

Yes, the same principle applies as far as it being beneficial for you to take advantage of discounts. But if cash flow is truly a problem, then it might make sense for you to forgo the discount in favor of sound cash flow management.

Can you get a few more days without sacrificing any sort of discount? That would be tremendously helpful. Every day counts.

Perhaps you’ve tried this with vendors before and have been told “no.” Ask again! The more you ask the more your vendor will understand how important it is to you. Hopefully, once they understand that, they’ll begin to consider it in the name of good customer service.

John Doe’s Restaurant’s solution

Given the nature of his business, John Doe doesn’t have any real problem with cash collection. He does, however, have to deal with a decent number of suppliers. Depending on how good of a day or week he’s had, sometimes the amount he pays his suppliers can cause cash flow crunches.

In order to remedy the situation, John Doe set aside some time to really look at each of his suppliers (and their terms) closely.

In the past, as was his personal habit, John Doe paid his suppliers as soon as he received the invoice. He wanted to be a good customer. He figured that since he was so small, it would keep him in good favor with his suppliers. Also, he knew that if you paid right away, you could take advantage of early payment discounts.

However, because he was interested in improving his cash flow, he decided to do things a little differently. He decided to handle each vendor individually rather than all of them in the same manner.

John Doe discovered that while discounts are always nice, some of them weren’t beneficial enough to offset the advantage of holding on to that cash longer. In instances where that was the case, instead of paying immediately, he made arrangements to make payment as late as possible. For some of his suppliers, this was 45 to 60 days after the statement date.

He also found that some of his suppliers had, what he considered, unnecessarily strict terms. In these cases, he contacted them individually and attempted to renegotiate terms. Not all of the suppliers cooperated. But, some offered bigger discounts for quick payment. Others pushed their terms out further into the future.

Manage cash with financing

5) Get purchase order (PO) financing

If you can’t talk your customer into making a down payment, you may have to finance purchase orders in order to take their business.

Purchase order financing is basically a short term loan for the purpose of paying for products/services so that your small business can complete the sale.

This is typically a somewhat costly option. But if getting this sale is the difference between staying in business and shutting down, then it’s something to consider.

6) Get a merchant cash advance

A merchant cash advance is where your small business gets cash upfront and then you repay that loan with a small percentage of your future sales.

Rather than paying back monthly installments, as with a traditional loan, you’ll likely pay the money back with micropayments over the course of days, weeks, or months. Obviously, as with any type of financing, there will be a cost to do so.

This cash management technique is frequently used by retailers and restaurants.

This technique can be used in conjunction with raising prices because you’re going to need that extra bit of margin in order to pay back the merchant cash advance. Make sure you have a smart plan to invest that cash advance money. It’s going to be costly, so make sure whatever using the cash for has a good ROI.

7) Factoring accounts receivable (AR)

This is another topic touched on in the Understanding Current Assets & Liabilities With Examples post/workbook. Factoring is also known as selling invoices. This is a technique where someone buys your accounts receivable off of you and pays a discount for them. So, you’re obviously not going to get as much for your sales. But, it will push the cash in your pocket right now.

Again, another situation where having high margins pays off.

8) Open a revolving line of credit (LOC)

You’re probably familiar with a revolving line of credit. 2nd mortgages are often lines of credit. As are credit cards.

So, it’s the same principle, just for your business. Borrow what you need, when you need it. As you pay the bank/credit union/financial institution back, you can borrow more.

The risk with any sort of borrowing is two-fold. First, there’s the matter of interest. The cost of money. The higher this is, the more expensive the payments will likely be.

The second risk is the fixed nature of the repayment. If sales go up, those payments are easier to make. If sales go down, they don’t change. They’re still the same fixed amount. This is why I harp on spending for good ROI on this site so often.

Learn more about how financial leverage can hurt or help you by reading this post.

Car Repair, Inc’s solution

Car Repair, Inc. is a one-location auto repair shop with aspirations to expand in the future.

Like John Doe’s Restaurant, Car Repair, Inc doesn’t have any issues collecting from customers. But, the owner has noticed

Obviously, some car parts are very pricey. And, since every make/model of car has its own unique parts, it’s can be costly to manage this type of inventory.

He’d also like to be able to advertise more to grow his business. If he were able to do so, he’d like to open up a new location, expand a current location, or purchase a competitor.

While he has enough cash flow to handle typical day-to-day operations, he doesn’t necessarily have enough extra to grow.

At first, he considered getting a term loan to address these issues. But, after investigating further, he found that a line of credit for his auto repair business would make more sense. A line of credit provides him with more flexibility. He only has to borrow what he needs at any given time, rather than having to apply for a new loan every time he wants to borrow more.

Plus, if he should ever find himself in a cash flow crunch because business is a little slower than usual; he has easy access to enough cash to get him by until business picks back up. The flexibility and versatility of a line of credit provide security for his business.

Big business decisions to help with cash management

Beyond the obvious cash management techniques, there are operational decisions you can make to put your small business in a better position going forward.

9) Sell idle fixed assets for cash

This is, of course only an option for assets that are sitting around taking up space. You don’t want to sell assets that are bringing in income. However, if you don’t think that they can be put to good use in the near future, consider selling them. Or, at the very least, leasing them out.

There are pros and cons to this technique. First of all, consider what it would take to buy the asset back if needed. Maybe you’ll be surprised to find it wouldn’t cost much more than what you can sell it for.

Just make sure that you don’t place your small business under further hardship for a quick influx of cash.

10) Turn down work?

This one is also a little counterintuitive. As a small business owner, you know that sales are everything. So you’re probably not in the habit of turning down business. However, depending on your line of work, and the nature of the business, maybe it makes sense to pass on some business. Particularly business that would require an enormous cash payment upfront or financing of purchase orders.

Maybe it doesn’t make sense to turn down the business completely. Perhaps it can just be postponed? If your cash flow forecast says that it would be better to do the work in a couple of weeks/months ask your client if they would be okay with that.

11) Increase prices/margins

Though this won’t necessarily bring in cash faster, there could be more of it when it finally does come in. At that time, more cash could be the difference between paying all of your expenses that are due, and only some of them.

You don’t necessarily have to increase prices across the board. You don’t necessarily have to increase them a lot.

Do you have a product/service that’s in particularly high demand? If so, can you add a couple of percentage points in margin?

Consider what’s unique about your business here. Think about the value you’re adding. When it comes time to pass along a price increase make sure you emphasize those points to your customers.

12) Switching to a subscription-based business model

As a small business owner, you know that it takes cash, time, and effort to make a sale. Probably a little less for a repeat sale. Even less for a loyal customer.

What if you only had to expend that cash, time, and effort once, and then could count on a customer’s cash to keep flowing in month after month? Doesn’t that sound better than starting from scratch after every sale?

There’s a reason that businesses are always pushing you to pay a monthly fee for unlimited products/services (or something similar). It’s because that sort of business model keeps consistent, predictable cash coming in.

Some industries lend themselves better to a subscription-based model, certainly. So, if this is something you’re interested in implementing in your small business, you might have to get creative. Look at your competitors or others in a similar industry. Are any of them offering subscription-based services? Ask yourself how you can tweak their model to make it your own.

Bookkeeper LLC’s solution

Now let’s consider Bookkeeper LLC. Bookkeeper LLC performs routine bookkeeping and some advisory services for other local small businesses.

In its early years, Bookkeeper LLC charged clients by the hour. It seemed, at the time, like a fair way to bill for the services provided. They only paid for what they needed. Most clients were fine with the arrangement.

Bookkeeper LLC noticed, however, that there could be a month or more between when services were performed and payment was received. In addition, as the owner of Bookkeeper LLC has gotten more experience, and more efficient, she’s making less money because she’s billing fewer hours. So, as time’s gone on, sales growth has been lackluster even though hourly rates have been raised.

Another problem that the owner of Bookkeeper LLC foresaw, was this – even if she was able to bring in more clients (to make up for the time she was no longer billing), ultimately there would be a point where she ran out of time. There are only so many hours in the day. As it stood, her business wasn’t scalable.

Also, like any other business that attempts to collect payment after the work is already done, Bookkeeper LLC ran into situations where collections from clients could

After struggling with these issues for some time, the owner of Bookkeeper LLC decided to pull the trigger and move to a subscription-based billing arrangement.

Some clients embraced the change

Other clients pushed back. But, the owner of Bookkeeper LLC explained to them how the change was beneficial. What they paid for her bookkeeping services would be more predictable and easier to budget going forward. In turn, she is indirectly helping her clients to better manage their cash flow.

After switching to a subscription-based billing model, Bookkeeper LLC now, effectively, gets its money in advance rather than after services are provided. Billing and receipts are automatic. Any cash flow problems that Bookkeeper LLC had in the past are now alleviated.

Because her revenue is so predictable, she’s able to manage expenses accordingly. Collections and other accounts receivable headaches are a thing of the past. Now she can focus on working on her business rather than in it.

13) Outsourcing – spend cash to save time

Maybe you’re concerned about your small business’ cash flow situation. But, you’re being pulled in so many different directions that you can’t make time to think on the matter. If so, this may be one of those instances where you have to spend cash to save cash.

Isolate what it is that is eating up most of your attention. Is there someone better qualified to handle this (e.g. bookkeeping or marketing)? Or, is it something where you can easily document your process and hire someone from Upwork or Fiverr?

Getting these sorts of tasks off your back can not only help you focus on the health of your business, it can improve your mental health too.

Jane Doe’s Web Design’s solution

The last business we’ll consider is Jane Doe’s Web Design. Jane’s company creates websites for local small businesses.

Since Jane’s business is a “one-woman show,” so to speak, she’s responsible for every task in the business. This doesn’t leave nearly enough time to do the things she is good at it (and actually gets paid for) – creating websites. Therefore, she doesn’t bring in as much cash as she otherwise could.

When Jane finally decided that she wanted to take control of her cash flow problems, the first thing she did was something that might seem counterintuitive. She spent cash to have other people take care of those things which she wasn’t good (or efficient) at

One of those things was marketing – specifically lead generation. Since she wouldn’t have to pay until new customers were brought in, the return on the investment was very good.

Also, since Jane isn’t a bookkeeper, she decided to pay for someone else to handle that too. The amount of time that this freed up allowed her to focus on her client’s needs and get websites done sooner. That led to getting paid sooner. It also allowed her to explore new technologies that could provide more value to her clients.

Finally, Jane decided to utilize the services of a virtual assistant. Just as with bookkeeping, doing so freed up an enormous amount of time which translated into more satisfied clients and a more satisfied by owner.

What is the management of cash flow?

Sales are the most important thing for any business. Cash flow is a close second, however.

What other tactics has your small business used to improve cash flow?

What industry-specific challenges does your small business face in terms of cash flow?

Hi there! Great post and very informative. Thanks for sharing your thoughts!

Thanks Sarah!