You’ve heard of a SWOT analysis. But, you don’t know where to start. Even if you did, you don’t have the time.

What if a SWOT analysis could really help your small business, though? What if it could provide direction and help you to look at business decisions through a more beneficial lens?

Are you certain that a SWOT analysis isn’t worth the time and effort? How much of either have you put forth in this pursuit, thus far?

What business decisions have you made recently that you felt were “off.” Do you feel like these decisions are nudging your small business in a decision you don’t want to go?

If you’ve read some of my other posts, you might know that I’m a big believer in the Pareto principle. I think that principle applies here.

Frustrated With Your SWOT Analysis? 15 Templates To Download

Most of the benefits of analyzing your opportunities, threats, strengths, and weaknesses will come from 20% (or so) of the time and effort.

Hopefully, this post will help you isolate that 20% and reap the rewards of a SWOT analysis.

The 5 minute SWOT analysis

- Set a timer for 1 minute

- Use the ideas I provide as inspiration

- Hyper-focus on each section of the SWOT analysis

- Don’t overthink

- Come back to the analysis with fresh ideas later

For each section, I suggest you take a timer and set it to a minute. Then, spend that minute laser-focused on the task at hand.

In the sections below, I’ll provide thinking points for your small business SWOT analysis. These will hopefully grease the gears and help you to utilize this time to create something useful.

Write down or type whatever comes to mind. Don’t scrutinize your answers too much – there’s not enough time!

The “5-minute” time limit is only used in the title to draw readership. Of course, if you want (or need) more time, take it.

Think of an opportunity while driving home? Discover a threat you had not thought of while reading the news? Has a customer mentioned an undiscovered strength? You can always return to your SWOT analysis and edit it.

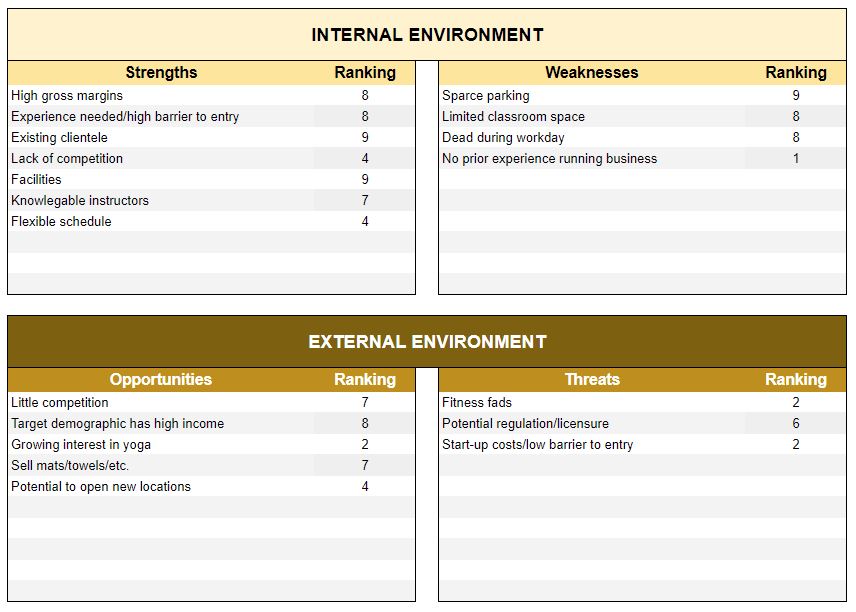

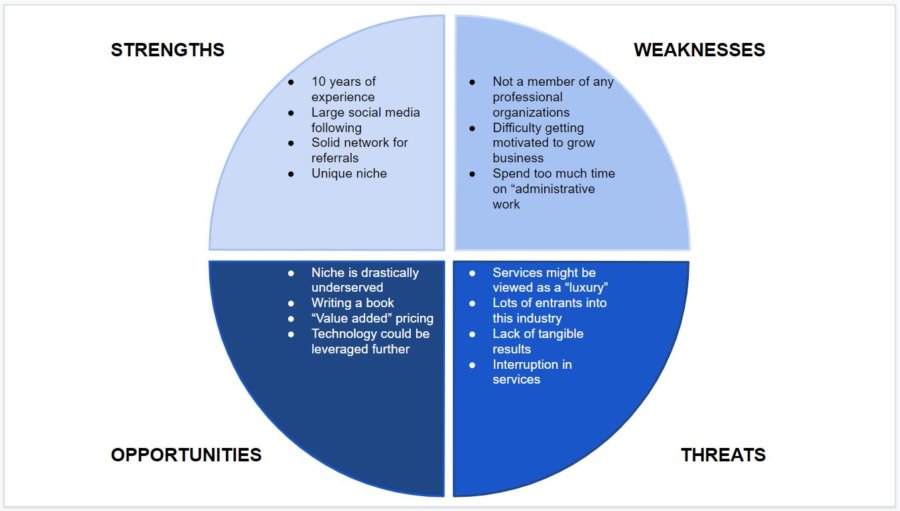

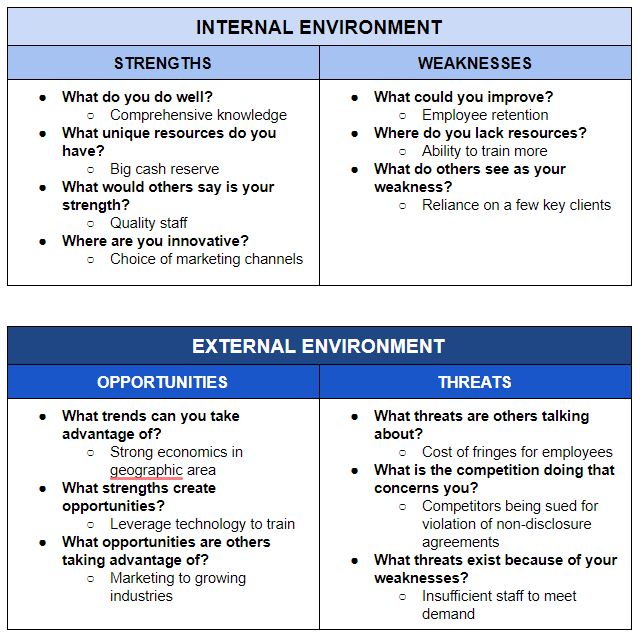

Opportunities

Opportunities may not always be obvious. If they were, every company would have a better chance of being successful. You need to keep looking for opportunities and you need to think hard on them if you find one.

Opportunities, in a SWOT analysis, are positive external factors affecting your business. They are outside of your control. Opportunities are great. But, your opportunities are most likely opportunities for your competitors too.

That being said, opportunities aren’t always obvious. If they were, every business would be successful. It can take a keen eye to spot opportunities. If you’re more of a pessimist – remember that nearly every threat can be turned on its head to represent an opportunity. And…vice versa.

It can also be difficult to know how to react to opportunities. But, if you can spot them and take the time to calculate your actions – the result can be very positive for your business.

Ideas for opportunities

- What is handled inefficiently in your industry?

- What middlemen are offering little value in your industry?

- What parts of your business can be digitized?

- What would your customers like to have customized?

- What training could you provide for customers or other businesses in your industry?

- How have franchises performed in your industry?

- What are the best-performing businesses in your industry doing right?

Competing on Price? There’s a Better Way: Value Pricing

Threats

Threats are things outside of your control. You should not worry about them for no reason, but make sure you try to be as realistic and reasonable as possible.

Threats, in a SWOT analysis, are negative external factors that could affect your business. They are also outside of your control. But, that doesn’t mean they can’t do serious harm.

Threats, like opportunities, can be turned on their head if you need ideas. Threats and weaknesses are what cause businesses to shut down. Especially when they work in tandem.

You don’t want to drive yourself crazy with threats. But, don’t stick your head in the sand either. Try to be as reasonable and realistic as possible.

Awful Marketing Results? Review These 5 Main Activities

Ideas for threats

- How strong is your current/potential labor force?

- What technologies could render your product/services obsolete?

- How would a recession affect your business?

- What demographic changes would hurt your business?

- What laws in other jurisdictions would negatively affect you?

- Are your products/services currently buoyed by any sort of fad?

- Is your business protected from physical risks (fire, natural disaster)?

- Could you withstand a doubling of costs?

- What substitutes for your products/services could erode market size?

Business Plan Demographics – Defining a Target Market

Strengths

Strengths are things that make your business special. This is what makes you better than other businesses. Use them to do good things for your business.

Strengths, in a SWOT analysis, are positive internal factors that (can) help your business succeed. They are unique to you and they give you an edge over the competition.

You want to crank these qualities up and get the most you can out of them. Particularly in instances where you can use your strengths to exploit opportunities or hedge threats.

Being humble is normally good. But, this is not a time for that. On the other hand, don’t let your ego get the best of you. Pretending you have a strength that you really don’t have, is a weakness.

Stay in Business With This Cash Budget Example + Spreadsheet

Ideas for strengths

- Is your brand well-known in the market you operate?

- Are your profit margins healthy?

- Are your employees creative?

- Are your business’s reviews positive?

- Is your location ideal?

- Does your business excel at quality, customer service, or speed?

- Are your budgeting, forecasting, and/or cost controls strong?

- Do you have the capacity to meet a surge in demand?

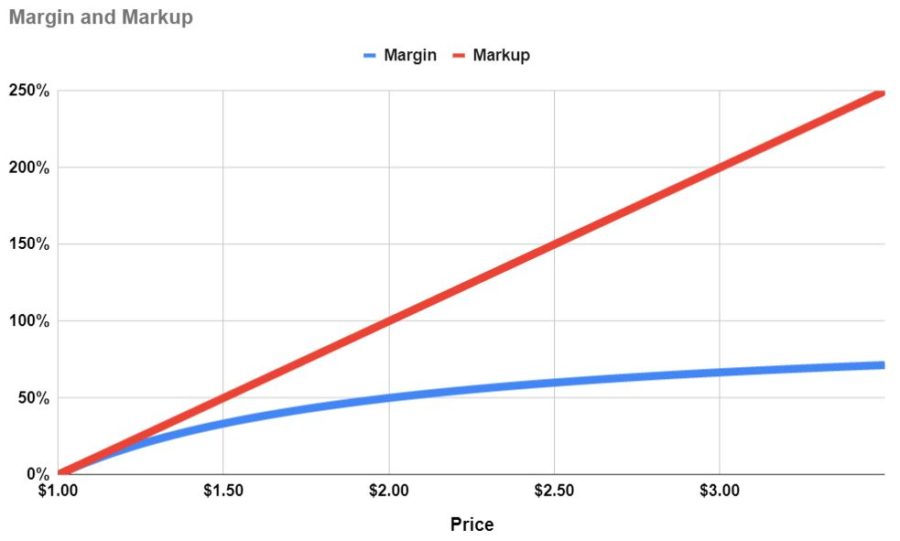

“How To Calculate Profit Margin?” Any Percentage

Weaknesses

You should try to improve your weaknesses. These flaws could prevent you from capturing opportunities in the future.

Weaknesses, in a SWOT analysis, are negative internal factors that (can) hurt your business’s chances of success. Your competition may or may not do these things well.

You should strive to improve these shortcomings. You don’t necessarily have to turn them into strengths. But, ideally, you’d like to get them to the point of being “good enough.” Weaknesses could prevent you from capitalizing on opportunities. They could also ruin your business if a threat comes along that exploits them.

Nobody likes to admit their shortcomings. Be honest with yourself here and get input from dependable third parties if you must. Weaknesses that are ignored can’t be fixed.

Remote Work for Small Businesses: How To Do It Right

Ideas for weaknesses

- Do you have excess inventory?

- Is your cash flow unpredictable?

- Are your products/services commodities?

- Is your business model sub-standard?

- Could someone run the business if you were unable to?

- Are you poorly managing or ignoring risks?

- Do your employees buy into your company’s mission?

Is 6.2 A Good Retail Inventory Turnover Ratio? Is 8.0 Good?

A quick SWOT analysis

A SWOT analysis is a good way to think about your business environment. You can find out if you have strengths, weaknesses, opportunities, and threats you weren’t aware of. It might seem complicated at first, but it will be worth it.

A SWOT analysis might seem like business school mumbo jumbo. And, it can be if you get lost in the weeds.

Hopefully, if you took the 5 minutes or so to perform a SWOT for your small business, you now have some ideas on:

- Opportunities to exploit

- Threats to protect against

- Strengths to utilize

- Weaknesses to fix

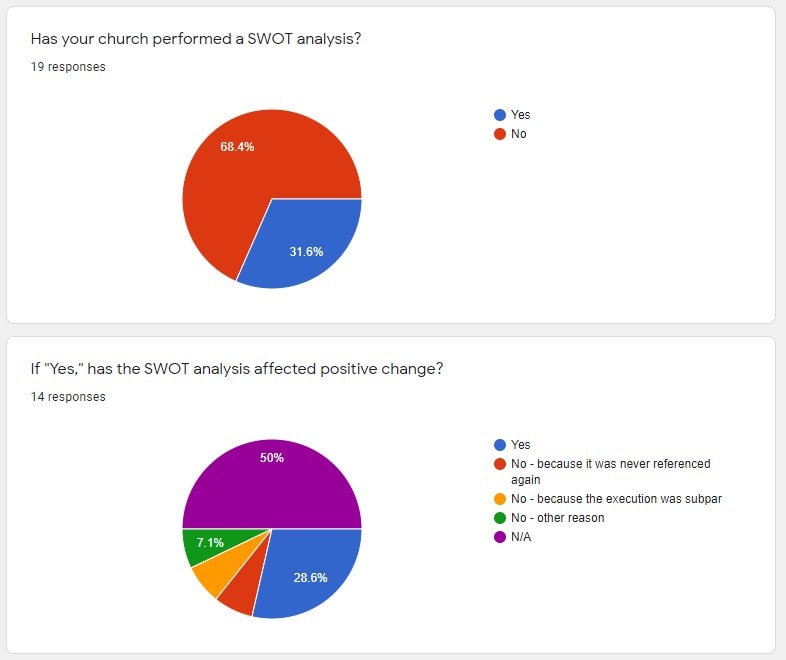

Finally, here’s a little food for thought as you work on your business’s SWOT analysis. This poll can be found in my church SWOT analysis post.

Church SWOT Analysis – A Comprehensive Guide

If you decide to perform a SWOT analysis (even if it’s a quick one) AND follow up with action, you’ll probably be in rare company. It could give your company the boost it needs to beat the competition and reach your growth goals.