Businesses use operating leverage to keep costs fixed when they expect extraordinary sales volume. Keeping costs fixed means that businesses can carry more of that revenue to net profit.

The degree of operating leverage is a formula used to calculate how much operating leverage a business is employing. This formula tells you what will happen to operating profit when revenue increases or decreases.

The degree of operating leverage can be calculated two ways.

The first calculation looks at past costs:

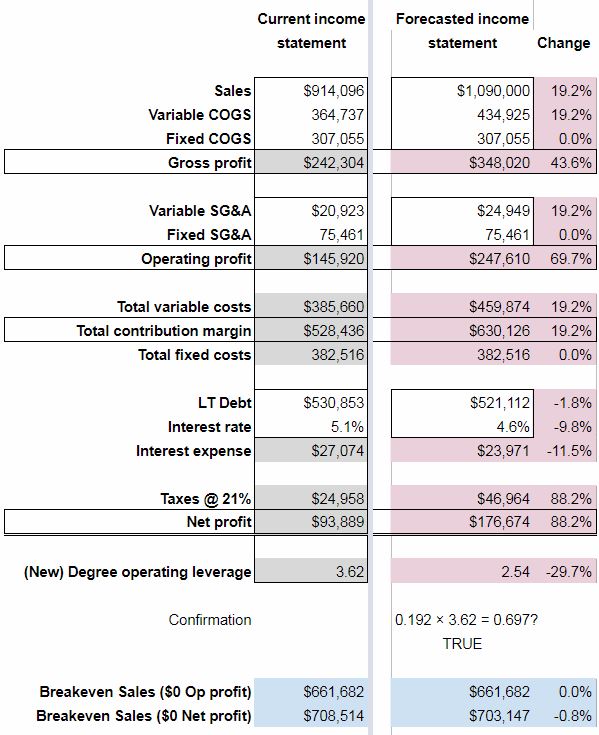

Degree operating leverage = % change in Operating profit (EBIT) ÷ % change in Sales

The second calculation looks at present costs:

Degree operating leverage = Total contribution margin ÷ Operating profit (EBIT)

If you don’t know your cost mix (variable vs fixed) then you don’t know how it’s affecting your small business. You don’t know if it would be advantageous to change the mix. And, if you did, what would happen. You don’t have a complete picture of your business and, therefore, aren’t making fully informed decisions.

Download the operating leverage workbook

Complete the form below and click Submit.

Upon email confirmation, the workbook will open in a new tab.

Degree of operating leverage and fixed costs

Operating leverage is the use of Fixed costs in order to amplify changes in Operating profit due to a change in sales.

Fixed costs might be considered risky because they do not change no matter how much you produce. But, they also don’t rise if you produce (and sell) more. The risk and reward go hand-in-hand.

The degree of operating leverage is a ratio that tells you how much your Operating profit will change due to a change in Sales.

For instance, if your degree of operating leverage is 5.0, then a 10% increase in Sales will translate into a 50% (5.0 × 10%) increase in Operating profit – all other things being equal.

Conversely, a 10% decrease in Sales will translate into a 50% decrease in Operating profit. The pendulum swings both ways.

Which formula should you use to calculate degree of operating leverage?

You can determine your small business’s degree of operating leverage through a couple of easy calculations. Or, you can just plug your numbers into the free workbook!

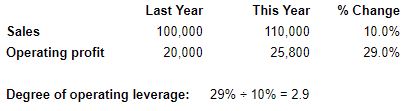

Some suggest calculating the degree of operating leverage as follows:

% change in Operating profit (EBIT) ÷ % change in Sales (Source)

For instance, comparing this year to last year, let’s say your Sales increased 10% and your Operating profit increased by 29%.

29% ÷ 10% = 2.9. That was your degree of operating leverage last year. This formula doesn’t tell you what it is now.

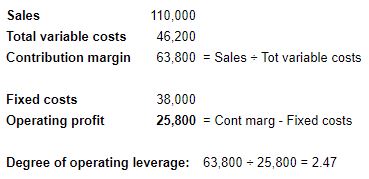

In order to calculate your degree of operating leverage right now, use the following formula:

Total contribution margin ÷ Operating profit (EBIT)

If you’re not familiar, Total contribution margin = Sales – Total variable costs. Not just manufacturing variable costs (Variable COGS), but SG&A variable costs too.

Degree of operating leverage and profit

Your degree of operating leverage can give you insight into the risks you run from your cost structure (mix of fixed and variable). It tells you how susceptible your Operating profit is to changes in demand.

It will also allow you to know how much you need in Sales to breakeven. The higher your Fixed costs, the higher that breakeven point will be.

Beyond that, it tells you if your Fixed costs are in line with your ability to generate Sales. If that ability is high, then your company can benefit from the leverage provided by Fixed costs and can earn excess returns.

Conversely, if those Fixed costs are locked into assets that won’t contribute meaningfully to Sales, then they are going to be a drag on Operating profit. You’re always going to be fighting against them.

A higher degree of operating leverage favors companies with good gross margins that make good project/investment decisions.

The different stories that operating leverage and financial leverage tell

My last post (with another free workbook) was on the topic of financial leverage.

Financial and operating leverage are similar in that they employ the use of fixed costs in order to (hopefully) amplify the effects of sales on net profit and operating profit respectively.

Here are a few of my thoughts on the subject:

Since financial leverage is owed for years to come, it is, obviously, long-term. Therefore, it should be used on long-term projects. Projects that will bring in extra revenue for years to come. Hopefully, even, beyond the point when the interest is paid off. Don’t use financial leverage for something that will provide a one-time spike in sales.

Operational leverage, on the other hand, is tied to assets that can be disposed of. They’re not very liquid assets, certainly. But they are typically a burden that can be relieved of easier than contractually owed interest. Real estate can be sold, salaried employees can be laid off. And so on…

Ironically, financial leverage is frowned upon and looked at as riskier than operating leverage. However, both essentially serve the same function. They’re components of the income statement entered at different places.

Fixed expenses can be a powerful lever or concrete boots that drag your company down. It’s all about how those fixed expenses are put to work.

How to understand and act on your degree of operating leverage

Once you know what your Degree of operating leverage is, then you will know what changes in Sales will mean for your Operating profit. If you don’t anticipate that Sales can be increased, then you’re going to have to explore means to reduce Fixed costs.

On the other hand, if you anticipate the Sales will improve next year, then you have to ask yourself if you’re willing to add more Fixed costs (that will further increase Sales). If you’re confident you can do so, you might have a really great year.

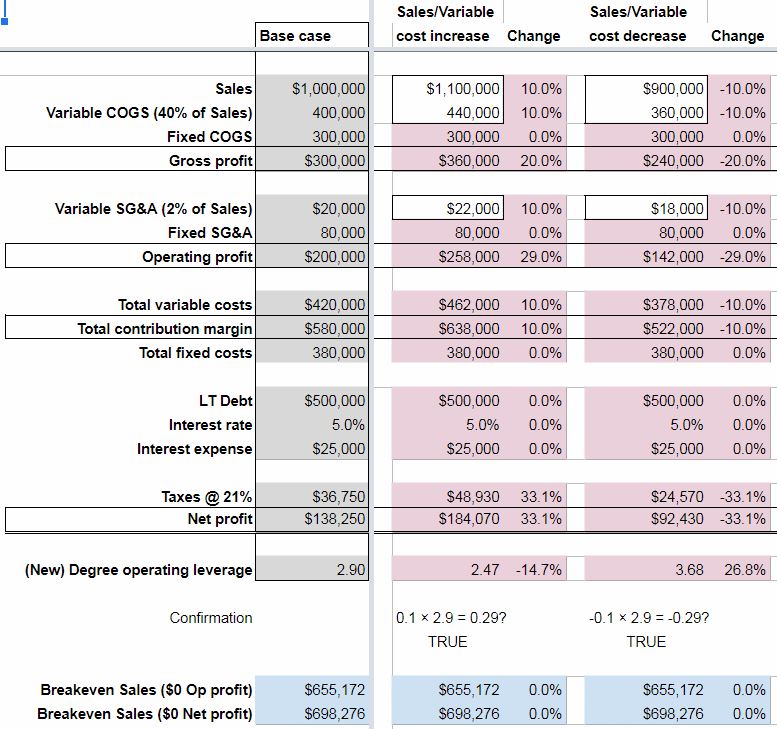

A change in sales or variable costs and the effect on a company’s financials

As can be seen on the Effects of changes worksheet – a 10% increase in Sales, Variable COGS, and Variable SG&A would translate into a 29% increase in Operating profit from the Base case. This is to be expected since the Degree of operating leverage for the Base case was 2.90 (10% × 2.90).

Keep in mind that Variable costs would increase at the same percentage as Sales – as is their nature.

The flip side is also true. A 10% decrease in Sales and Variable costs means a 29% drop in Operating profit (-10% × 2.90).

Note that the Breakeven Sales amount doesn’t change in either scenario. This is because Fixed costs didn’t change.

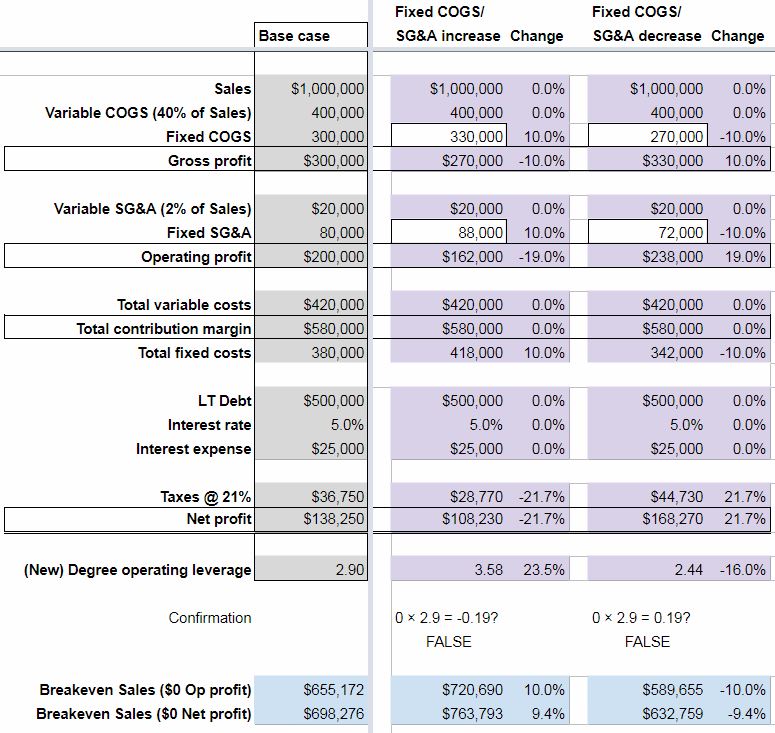

A change in fixed costs and the effect on a company’s financials

“Why would fixed costs change?” you might ask. “They’re fixed,” you say.

Well, in theory, they don’t. But in practice, they might.

First, not many costs are 100% fixed or variable. It’s a sliding scale. Over a long enough timeline, all costs are variable they say.

Also, Fixed costs are often tied to fixed assets. Fixed assets are acquired and disposed of over the years. Salaries, which can comprise a lot of Fixed costs too, fluctuate with the hiring and loss of employees.

So, as you can see, it’s not much of a stretch for Fixed costs to change.

When they do, we can see that a 10% increase in Fixed costs translates into a 19% decrease in Operating profit. Not at all what we would expect from our Confirmation equation. 0% × 2.90 = 0%! Operating profit shouldn’t change!

But in this hypothetical example, it did. And, in real life, it could.

Of course, the opposite was true too. A 10% decrease in Fixed costs meant a 19% increase in Operating profit.

Notice, too, that a change in Fixed costs meant a change in the opposite direction for the Breakeven Sales amount. Not surprisingly.

What will the degree of operating leverage tell you about your company?

Don’t forget, you can get insight into the degree of operating leverage for your own business by accessing the accompanying spreadsheet for this post. Just enter your information in the white cells on the Your degree of operating leverage worksheet.

Fill out the form at the top of this post ↑ for quick, easy, free access.

What are your thoughts on the use of operating leverage vs financial leverage?

What is your degree of operating leverage and would you like to increase or decrease fixed costs?