Video Transcript

00:00 I’m gonna go over how to go about making

00:04 operating budget for your church some of

00:06 my previous videos you know I’ve done a

00:08 little more in depth with the individual

00:10 spreadsheets and how you know what each

00:12 field is about how its calculating

00:14 everything this time I’m going to try

00:16 something different I’m gonna stick to

00:18 kind of summarizing here and I’m gonna

00:19 put a link down in the description where

00:21 you can read the whole in-depth post

00:24 that covers every single aspect you know

00:27 in detail of the operating budget for

00:30 your church and the video here is just

00:32 gonna be kind of a summary so that being

00:34 said let’s get into it

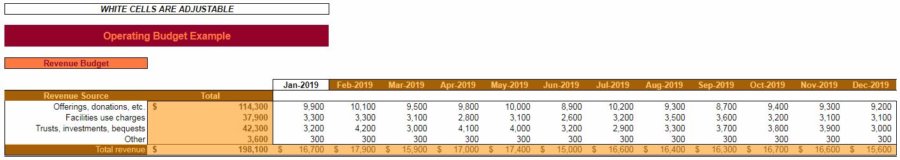

00:36 we’ll start off here with a ordinarily

00:41 with a for-profit company you always

00:44 start with a revenue budget with the

00:45 church you have a little flexibility

00:47 there you start with a revenue budget or

00:48 with your expense budget so for the sake

00:52 of simplicity I’m going to walk through

00:54 this starting with the revenue budget

00:55 but you know it really is a matter of

00:59 private preference do to kind of

01:01 churches unique situations so revenue

01:04 budget is exactly what it sounds like

01:06 it’s a budget in a forecast for all of

01:08 the money you’re gonna bring in for the

01:10 year so in this case we’ve got the

01:13 different sources listed here offerings

01:15 donations facility whose charges trust

01:18 investments and other okay and we reject

01:21 them out for every month for the coming

01:23 year but the first month of our planning

01:25 period here so if you’re planning

01:27 creative begins in July or September or

01:29 whatever some other month with that in

01:32 there it’ll automatically populate it

01:33 out and all the forecasted amounts are

01:38 total by month and total by source also

01:42 point out real quick that all

01:44 spreadsheets for business templates

01:46 which there’ll be a link to the template

01:49 in the link to the post so you get that

01:53 by going to the post but all

01:56 spreadsheets for business workbooks the

02:00 white cells are adjustable okay the

02:02 colored in cells or other formulas or

02:03 their text so unless you really really

02:05 know what you’re doing don’t touch those

02:07 so revenue budget is pretty simple and

02:11 we’ll move on to the expense budgets now

02:16 let me get rid of the fixed cells here

02:21 there’s separate expense budgets for

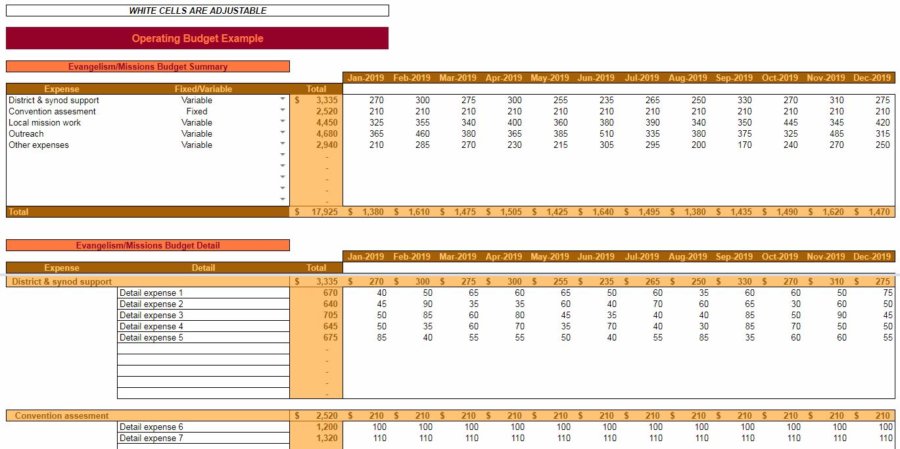

02:25 each of the four kind of broad

02:26 categories of expenses the inspiration

02:29 for these categories comes from Bree mal

02:31 FERS if you’ve done any searching on

02:33 YouTube or on the web in regards to

02:36 Church strategic planning you’ve come

02:37 across

02:38 Audrey’s work and he’s does a great job

02:42 and you know definitely a good source of

02:47 information I’ve never seen him put

02:48 forth anything like this not to say that

02:50 he hasn’t that I used a lot of his

02:54 inspiration in creating this template

02:57 for budgeting so now he breaks it church

03:02 expenses into four broad categories

03:04 evangelism emissions personnel

03:06 ministries and facilities so as you can

03:09 sing along the bottom here that’s

03:10 exactly what we’ve done

03:12 each of these four budgets is formatted

03:15 in the same manner so for simplicity

03:17 sake we’ll just look at the evangelism

03:21 and missions budget here so what you got

03:26 at the top here is you know basically

03:29 when it would take those broad

03:30 categories expenses and break them down

03:31 into subcategories so do that first and

03:35 foremost for the evangelism missions

03:36 here and direct and Synod support

03:39 Convention Assessment local mission work

03:40 outreach etc of course each broad

03:44 category has its own separate sub

03:48 categories you came and you’ll notice

03:52 also you’ll have to fill those in

03:54 manually and also you’ll notice that

03:56 each bra subcategory of expenses gets

04:03 category wrap categorized as fixed or

04:06 variable and simply put the post goes in

04:11 a little more detail but you know fixed

04:14 is gonna be the same no matter your

04:16 level of revenue a more revenue less

04:19 revenue you would expect this expense to

04:21 stay the same

04:22 variable on the other hand you would

04:24 expect to increase with revenue and

04:25 decrease increase in decrease with

04:28 revenue less revenue less expense more

04:29 revenue more expense okay so you’ll see

04:32 that all these amounts are filled in

04:34 here a lot of them with zeros because

04:36 there’s a room for plenty of

04:38 subcategories well where’s that

04:39 information come it comes from down here

04:41 below this is where you get into the

04:42 detail okay so you’ll notice each sub

04:45 categories listed here and you can

04:47 detail expenses and this is where you

04:48 actually put in the inmense so you know

04:51 you take a broad category of expenses

04:53 break it down to subcategories break it

04:55 down further into details you know

04:58 depending on the sophistication of your

05:00 accounting software or your accountant

05:04 you know this could be these detailed

05:06 expenses here could be individual GL

05:08 accounts or whatever you want them to be

05:11 but as long as you address all expenses

05:14 that’s all that really matters it’s just

05:16 like I said kind of breaking things down

05:18 here into manageable chunks to where you

05:22 can forecast them out for every month in

05:26 the planning period then they’ll total

05:29 here and those totals will carry up here

05:32 okay so you’ll see like I said every

05:36 subcategory of expenses listed here with

05:39 plenty of room to entered detailed

05:42 expenses okay so you do that for

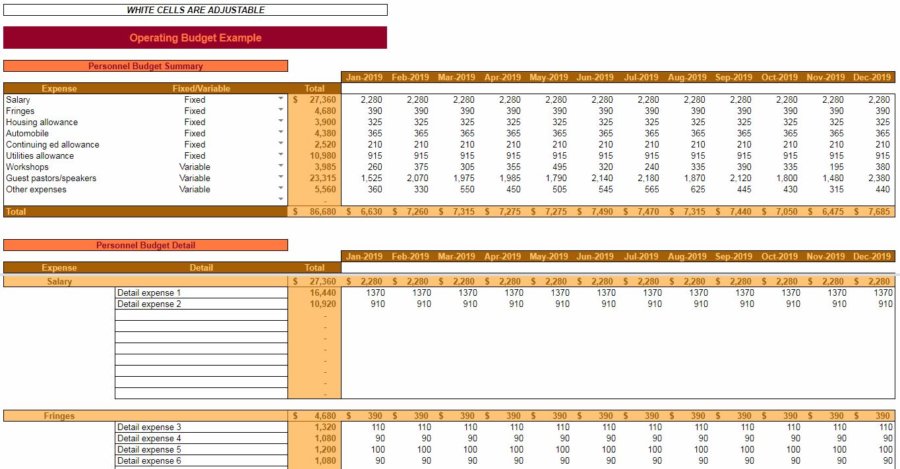

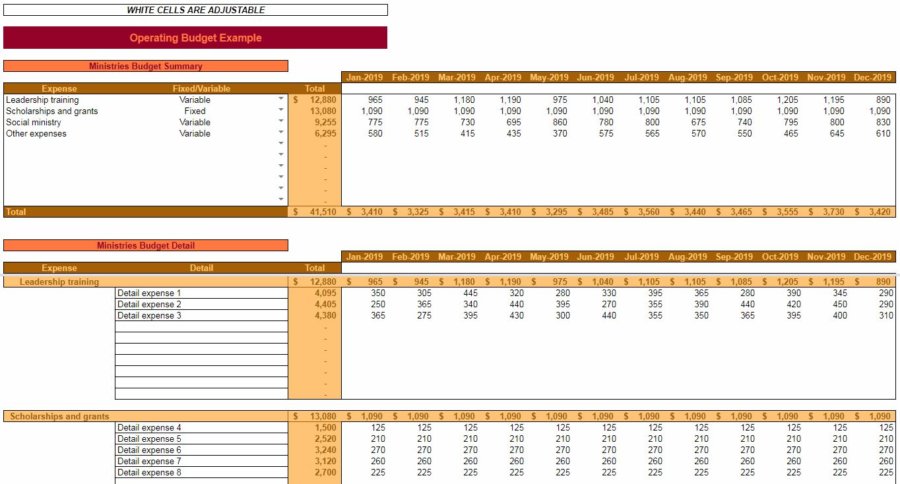

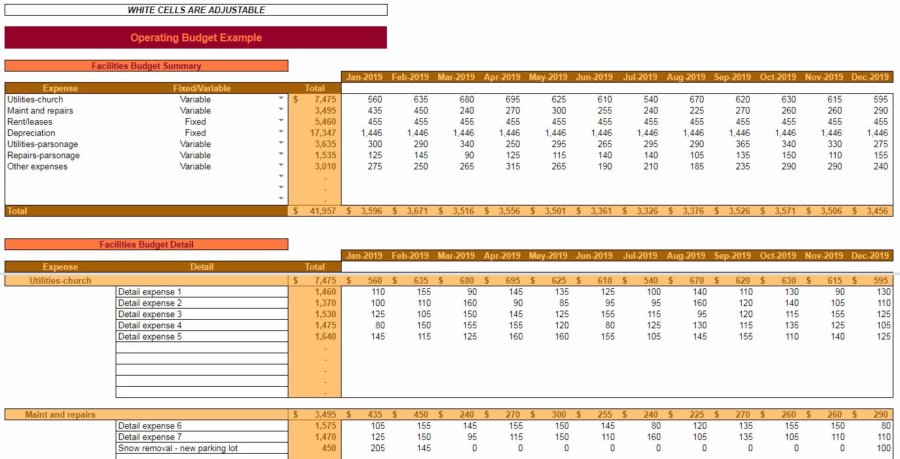

05:45 evangelism and admission you do that for

05:50 personnel do it for ministries it’s all

05:55 them all the same same format do it for

05:58 facilities so okay you better you expect

06:01 the revenue for the year then you

06:03 entered your expected expenses for the

06:07 year don’t forget like in this example

06:09 real quick here you’ll notice this ties

06:13 into the capital budgeting work that we

06:18 did – I like to make my workbooks tie

06:22 into each other so it can paint the

06:24 entire picture for you guys so that’s

06:26 what this means you know most of these

06:28 are Justin Eric detailed expenses but

06:30 this one here talks about snow removal

06:32 and it has to do with the

06:34 creation of a new parking lot that we

06:36 looked at in the capital budget so check

06:38 that video out to check that post out to

06:41 so and yeah once all expenses are

06:46 entered then that’s the biggest part of

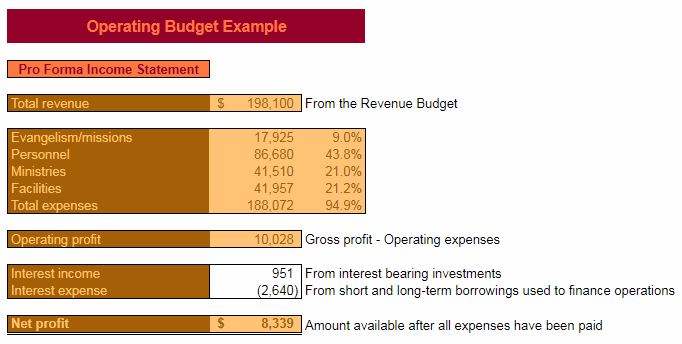

06:51 budgeting okay all that’s going to carry

06:54 over here into your pro forma income

06:56 statement where you’ve got your total

06:58 revenue your total for each expense by

07:02 broad category okay and then we threw in

07:05 a percentage amount here

07:08 that’s a percentage of revenue if I

07:11 remember right yes it is okay just just

07:15 kind of paint the picture of what

07:18 categories are contributing most to your

07:20 expenses then we’ve got operating profit

07:23 which is revenue minus expenses one

07:27 other thing you have to fill in I mean

07:28 pro forma income statement here that

07:30 isn’t really covered elsewhere in the

07:31 operating budget is interest income in

07:35 interest expense okay so this is a will

07:39 have to be a forecast you’ll just have

07:41 to look at you know for income if you

07:44 have income earning assets savings you

07:49 know money market accounts something

07:52 that maybe earns a little more than that

07:54 dividends perhaps enter now here

07:57 interest expense it’s gonna depend in

07:58 large part on the amount you need to

08:00 borrow a lot of that will be covered in

08:02 the financial budget okay but you know

08:05 you can go ahead and do your financial

08:08 budget which I’ll cover in a later video

08:09 and a post that’s coming soon and circle

08:13 back around enter that information here

08:14 too okay you’re not gonna be graded on

08:18 your accuracy in terms of forecasting

08:20 this can be a living document come back

08:21 and change it as you need to

08:23 all right so operating profit minus

08:25 these interest expenses churches don’t

08:27 pay taxes so there’s net profit okay

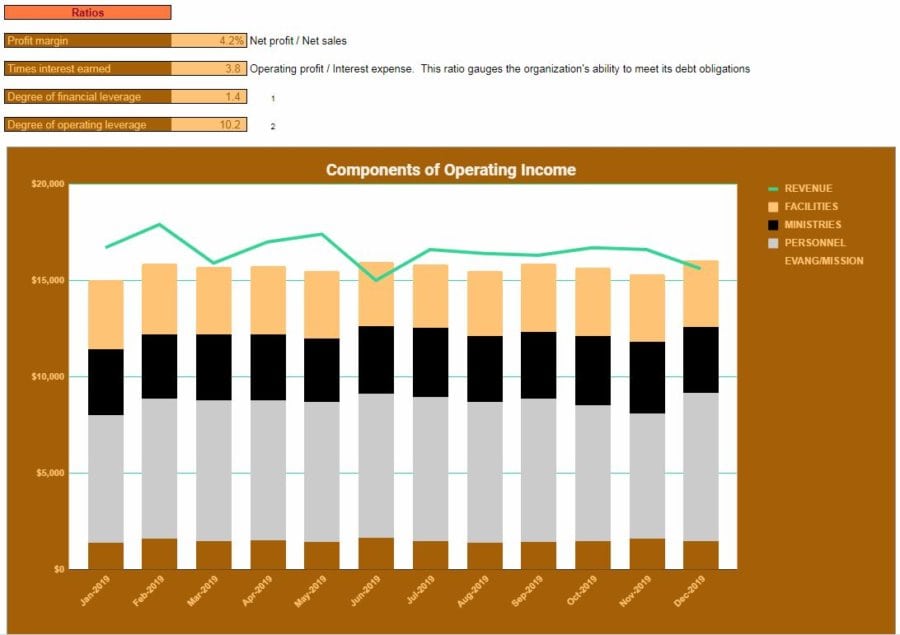

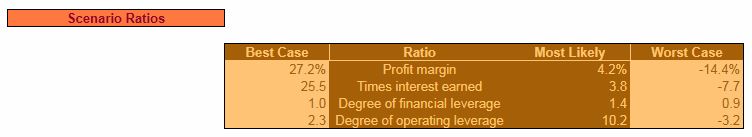

08:32 there’s a couple of simple ratios left

08:34 in here that are applicable for churches

08:38 okay got profit margin which is pretty

08:39 self-explanatory you know your net

08:42 profit compared to you net sales times

08:44 interest earned looks at those

08:46 looks at interest expense and operating

08:50 profit how it relates to it degree of

08:53 financial leverage again the post will

08:54 get into more detail in degree of

08:56 operating leverage we’ll get more detail

08:58 on that too those are two interesting

09:00 concepts that basically tell you what

09:07 the based on degree of financial

09:10 leverage based on the amount of money

09:14 you borrow what effect increasing and

09:20 decreasing

09:21 operating profit would have on that or

09:25 the rather the effect you’ll have to

09:29 read the posts to get a detail because

09:30 if I start talking about it I’ll go on

09:32 for an hour here and like I said and try

09:34 to make this summary so basically the

09:39 effect of degree of financial leverage

09:41 is the effect of interest expense on

09:45 profit degree of operating leverage is

09:47 the effect of fixed expenses fixed costs

09:52 on profit okay and that’s why I asked

09:56 you guys to specify whether costs are

09:59 fixed or variable here okay so that’s

10:01 what that was for read more about that

10:03 like I said you’ve got the chart down

10:06 here pretty straightforward just an

10:08 illustration of what happens month by

10:10 month based off of your forecast you’ve

10:12 got the Green Line is revenue and then

10:15 you’ve got your different categories of

10:16 expenses here you can see how they rise

10:18 and fall in total and by categories so

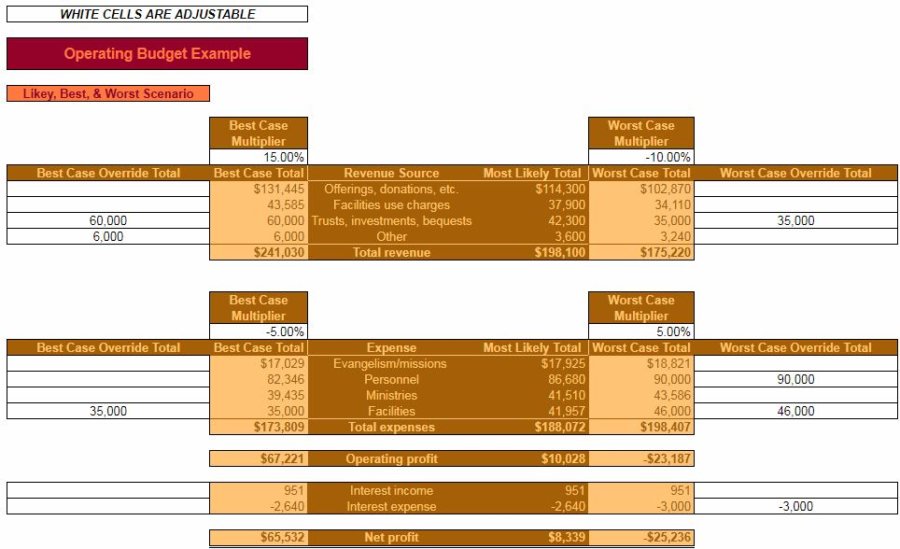

10:22 one little extra bonus that I like to

10:26 add to my industry specific spreadsheets

10:29 is this likely best case worst case

10:33 scenario okay I think this is super

10:36 valuable you know and it’s it is another

10:39 step and the whole strategic planning

10:43 thing which is time-consuming in that

10:44 bed really is just the like I said the

10:50 plus one however you want to put it to

10:53 to the operating budget this is where

10:56 you know you’ve done you’ve been in put

10:58 your

10:59 expected revenue cost profit etc now you

11:02 get to toy with what the worst case

11:04 would be in the best case would be and

11:06 this just like most of strategic

11:08 planning

11:09 just get your mind working in that

11:10 direction so you’re you’re completely

11:14 comprehensively prepared for the

11:15 upcoming year okay so it starts off here

11:19 with the pro forma income statement

11:26 that’s what this is sure if it Proform

11:28 in there but yeah it’s a pro forma

11:31 income statement or rather this yeah

11:35 sorry okay so this is revenue up here

11:37 where you can toy with best cased amount

11:40 for each revenue source

11:45 worst case amount or you can just use a

11:48 generic multiplier okay so basically

11:52 what that means it’s like if I change

11:53 this worst case is gonna be negative in

11:55 the case of revenue the 15% you’re gonna

11:59 see these worst case amounts decrease

12:03 okay because I made the worst excuse me

12:08 in the worst case that much worse

12:10 okay but you have so you can change that

12:15 there it will affect everything in that

12:17 section but you also have the ability to

12:20 override it okay so see if we delete

12:25 this worst case would be 38,000 versus

12:31 42,000 for trust investments in the

12:34 quest but you know say you think no no

12:38 worst case could be worse than that or

12:40 worst case wouldn’t be quite as bad well

12:43 then you just override that amount okay

12:46 everything else is based off of this

12:48 multiplier but now you’ve overwritten it

12:51 with an amount so same same principle in

12:55 the best case I’d come down here to

12:58 expenses we have our abroad expense

13:00 categories again use a multiplier this

13:04 is just a ballpark figure the multiplier

13:06 basically if you know best-case in the

13:10 Fuhrer expects is going to be the

13:11 decrease

13:12 worst case for expenses gonna be the day

13:15 increase and I keep doing it

13:17 so keep that in mind and you can

13:20 override you don’t like what you see so

13:22 yeah just toy with it you know that’s

13:25 the whole point of this exercise just

13:28 toy with it see what playing with

13:32 different scenarios gives you what it

13:35 makes you think about what you might do

13:37 to plan to avoid a worst case what you

13:39 what planning you might do to take

13:41 advantage of the best case okay so just

13:44 like the pro forma income statement on

13:45 this executive summary

13:47 you got your operating profit here you

13:50 can see negative under worst case this

13:54 will match what’s on the executive

13:55 summary the ten thousand twenty eight

13:58 operating profit and best case

14:05 considerably better six times the

14:07 operating profit so that’s pretty good

14:10 it brings in interest income and expense

14:14 here also and then that profit always

14:20 calculated the exact same as it is on

14:21 the executive summary so then of course

14:25 the you know the whole purpose of ratios

14:26 is to kind of put amounts into

14:31 perspective from your financial

14:34 statements and the same thing takes

14:36 place here you know profit margin can

14:38 range from negative seventeen point

14:41 eight to twenty seven positive twenty

14:43 seven point two times interest earned

14:45 degree of financial leverage is going to

14:48 change all that it’s gonna going to

14:50 change based off of what you enter in

14:52 the best case in worst case fields above

14:57 some anyhow that’s quick rundown of the

15:01 church operating budget template you

15:04 know go get your own copy to toy with I

15:06 get his follow the link and there’ll be

15:10 a links on there follow a link to the

15:13 post there’ll be links on there to

15:14 download your own copy of it and then

15:16 you know you if you’re dealing with

15:18 concepts you’re not familiar with just

15:20 check out the post I’ve got more or less

15:22 every single field on here

15:24 addressed in there and you know if you

15:28 get stuck on something just check that

15:30 out and it’ll help you make sense what

15:33 you’re looking at so appreciate you

15:35 guys’s time appreciate you watching this

15:39 video if you have until this point the

15:41 very end YouTube it is a popularity

15:45 contest just like anything on the

15:47 Internet and if you like this video if

15:50 you think this seems like something

15:51 useful to you best way to let me know is

15:55 to either leave a comment down below or

16:00 better yet maybe I don’t know depends on

16:03 the YouTube algorithm comments are good

16:06 likes or good subscriptions are good I

16:08 know

16:10 alerts are good any of that stuff you

16:13 know I’ll feedbacks good I’ll crank out

16:16 more content there’s also a lot of stuff

16:19 to check out not just for churches but

16:22 for small businesses in general on

16:23 spreadsheets for business comm thanks

16:26 you guys take care