Some small businesses are quick to embrace technology. Others, not so much.

For small businesses in technology-heavy industries, it’s natural, and often necessary, to understand digital trends. Other small businesses are in more “traditional” industries. Even if they wanted to be on the cutting edge of technology, they’ve still got a business to run. An “analog” business that doesn’t need digital dohickeys to operate.

Digital advertising is a complicated subject. Navigating this domain takes a certain amount of know-how. It might even require the help of somebody with in-depth expertise. This post won’t tell you everything you need to know about digital advertising. Hopefully, it will start you on a path to understanding what your next steps should be.

Consider the following:

- Are you able to calculate an ROI for your non-digital advertising?

- Do you currently know all of the digital advertising options available to your small business?

- What other technological tools have you tried and been pleasantly surprised with?

- How can you manage your small business’s digital advertising so that it provides a satisfactory ROI?

Awful Marketing Results? Review These 5 Main Activities

What’s the worst that can happen? You can do nothing and your competitors can gain an upper hand. Perhaps jeopardize your business’s existence. Or, you can be proactive and learn a little about this subject so that you can proceed with confidence.

Digital vs traditional advertising

If the media you’re using was created before the internet – it’s traditional. After – it’s digital.

Tradition advertising includes the following mediums:

- Billboards

- Radio

- Broadcast television

- Direct mail

- Magazines

- Newspapers

- Anything tangible

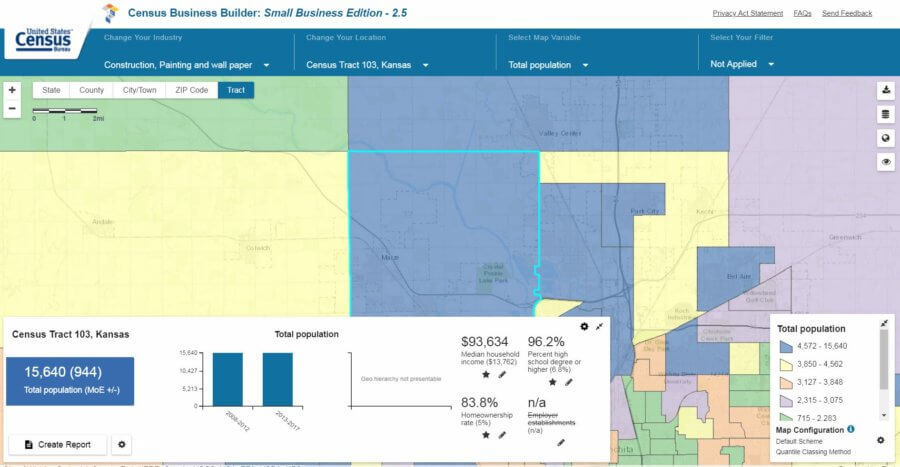

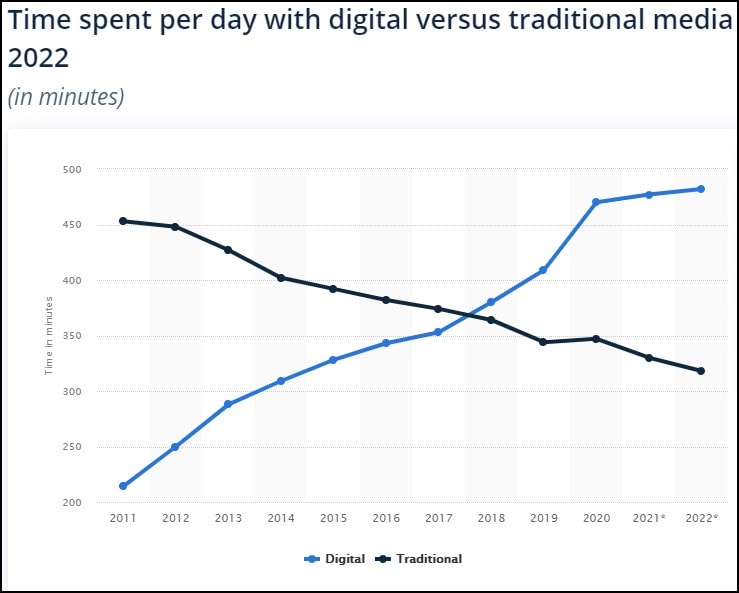

Not surprisingly, attention has shifted over the past 10+ years away from traditional mediums toward digital. In fact, in 2018, it’s estimated that digital media eclipsed traditional. Source.

Simply put, advertising is when you pay for a place to talk about your company. The goal of advertising is to find people who want what you have and convince them to buy it. It follows, of course, that advertising is going to gravitate toward where the attention is.

“I still use, and benefit from, traditional advertising” you might be saying. If traditional advertising is working for you, you’re not going to abandon it. It might be time, however, to start gauging exactly how well those old mediums are working for your small business. One of the simplest ways to do this is to simply ask how customers found you.

Why is digital advertising superior to traditional?

- Digital advertising is direct and can be tied to sales

- It lets you make low-cost changes or try new things

- It requires less of a time and money commitment

- It facilitates feedback

- It’s easier to reach your target audience

First and foremost, what makes digital advertising most appealing is its direct interaction with customers. Traditional advertising is more indirect. It’s easier to tie a sale to digital advertising than traditional. This analytical data is priceless when it comes to inventory management, product development, and other marketing duties.

Is 6.2 A Good Retail Inventory Turnover Ratio? Is 8.0 Good?

Digital advertising also allows you the ability to edit, tweak, and A/B test. With traditional, once it’s out there, it’s out of your hands. You can certainly make changes the next go-around. But, traditional advertising can’t compete with digital in terms of flexibility.

The time and money commitments are also less with digital advertising. At least with a given provider/medium. This, coupled with its flexibility, allows you to fine-tune your digital marketing message in a much more efficient manner.

Simple Small Business Cash Flow Template, 7 Week Projection

Feedback is another important consideration. Conveying everything you want your customers to know in limited print space or during a 30 second TV/radio spot is tough. Customers are still left with questions. Digital advertising helps to address your customer objections. This can be done by communicating with them directly, or by making it easy for them to learn more about your products or services.

Finally, it’s easier to get your marketing message in front of your target audience (customer avatars) with digital mediums. This means less waste than with traditional means.

Business Plan Demographics – Defining a Target Market

Downsides to digital advertising

- Traditional has more research

- Not all customers are accessible online

- Ad blockers limit exposure

- Obnoxious ads can repel customers

- Complexity and information overload

Digital advertising is still relatively young. And, while the actionable insights are greater, digital advertising simply doesn’t have the decades of research that traditional advertising does.

There are other “cons” too…

Your customer avatar might not spend time online. And, if they do, they might go to great lengths to protect their privacy or not share enough to be identified.

Traditional advertising is subject to space constraints. But, so is digital advertising. It’s relatively cheap to produce, but not every digital piece of content gets in front of a lot of eyes (trust me!). Social media and the web are winner-take-all domains. So, “prime real estate” is highly sought after and could become cost-prohibitive.

We all know that digital advertising can be obnoxious. Ad blockers are very popular and as advertisers get more creative on how to work around them, the creators of these tools get more creative too. If your target demographic uses ad blockers, then your ability to reach them could be hindered.

Finally, all of those advantages listed above create more complexity. There is a lot of information to wade through and a lot of decisions to make. It can overwhelm you if you let it.

Types of digital advertising

Digital advertising includes the following mediums:

- Search engine

- Social media

- Streaming

- Websites

- Videos

- Anything internet or web related

Keep in mind that these are ever-evolving and this list could grow or these mediums could be obsolete in a relatively short amount of time. Also, there are some blurred lines between these different mediums. Some digital advertising could qualify under two or more of these categories.

Here’s a very general idea of what each medium entails.

Search engine PPC (pay per click) ads appear when people search the web. When, where, and how much it costs for your ads to appear is typically is decided by an auction system.

Social media ads utilize the information that platforms know about their users. This allows you to target very specific types of customers. The ads typically take the form of the normal content on the platform.

Advertising on streaming services is similar to TV advertising. But with a little more control over who sees your ad. Rates for this type of advertising can vary considerably. There is also the cost of production to consider.

Website advertising can also be done on a PPC or cost-per-impression basis. This type of marketing allows you to incorporate graphic elements more than search engine advertising. Which comes at the slight cost of not being able to target your audience quite as well.

Video advertising allows your small business to piggyback on specific topics. TV has conditioned us to tolerate streaming ads – to a degree. However, I think that video (YouTube) advertising had the distinct challenge of competing directly with the content your customers actually want to see. It’s like someone standing in front of their screen when they just want to watch a movie trailer.

How to get started with digital advertising?

- Create a website and social media profile

- Learn about what increases exposure (for free)

- Try other platforms

- Draw inspiration from others

- Dip your toe into paid promotion

- Learn the relevant advertising metrics

- Keep failures small and adapt

- Get help as needed

- Exploit high ROI opportunities as you find them

Familiarize yourself with the digital “terrain” before moving forward with advertising. The name of the game in digital marketing is understanding algorithms and keywords.

The first step would be to create a website if you don’t have one. Try to get it to rank high on search engines. This will help you learn a little about SEO (search engine optimization).

Also, pick a social media platform to experiment with. Try to find out what constitutes popular content and what doesn’t. Once you feel comfortable on one platform, try another.

Don’t be afraid to copy what others are doing. Don’t make carbon copies, but do look to what works for inspiration.

Once you’re comfortable with the “free” marketing, dive into the paid side of things.

Understand your conversion rates, the value of your customers, and your costs.

Pricing Strategies for Startups and Established Businesses + Spreadsheet [VIDEO]

You’re going to fail. Keep those failures small and learn from them.

You might consider getting help with the finer points. Tap into any skills that you may have within your staff. If needed, hire out help. There’s no shortage of digital marketing agencies out there.

Proceed smartly. Get feedback. Learn from it and adjust. When you finally discover that super-high ROI message/medium – put your foot on the gas and reap the rewards!

Here are some videos that will hopefully help you get the ball rolling with digital advertising:

▲ That’s a long, in-depth video. If you’d like something shorter, here’s another:

Distinguishing advertising and marketing

Throughout this post, I have used the terms advertising and marketing interchangeably. They are not synonymous, however. Here’s how I’d draw the distinction:

Marketing is about understanding your customers and what they need. Advertising is a way to promote your company. It is just one part of marketing.

Utilizing digital or traditional advertising isn’t a black and white matter. There are shades of grey. If you feel that the advantages of digital advertising are worth it, you should consider transitioning to the extent you are comfortable.