Usually, when people think about a business, they think of an organization that employs many people. Not every business is like that, though.

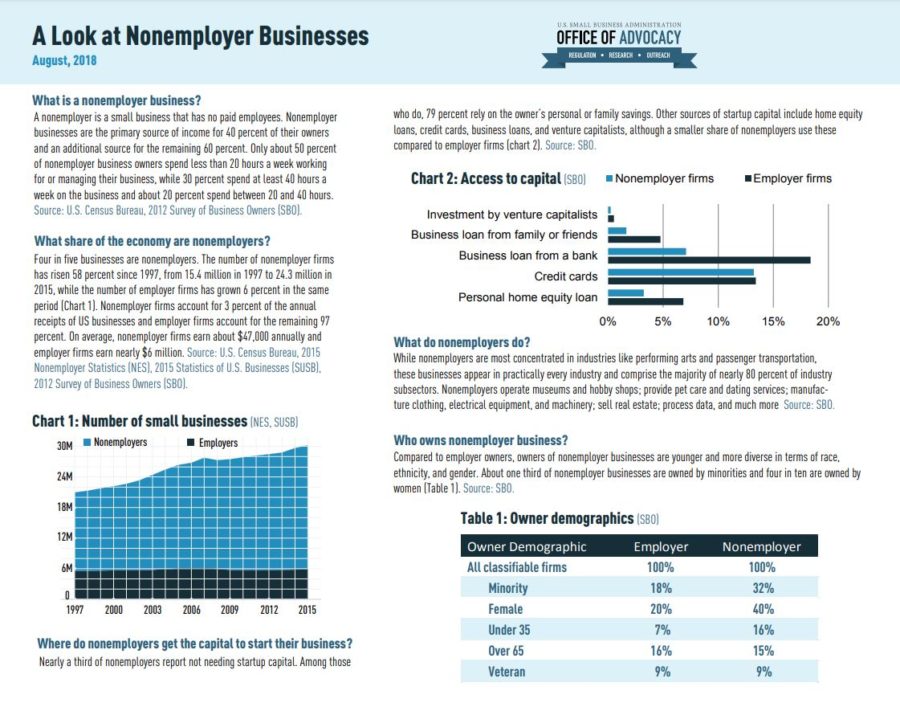

In fact, many small businesses are one-person operations. The Census calls them “nonemployer” businesses and collects a lot of information about them.

Maybe you have an entrepreneurial streak, but don’t work well with others? Well, every business has to deal with customers in one manner or another. But, if you prefer to work alone as much as possible, then it might surprise you how successful a company-of-one can be.

Does working with other people stress you out?

A one-person business is pretty self-explanatory. Like anything, though, operating a one-person business has its ups and downs. Knowing what to expect will help you be prepared if you decide that being a “solopreneur” is right for you.

What is a one-person company?

Read how the Cambridge Dictionary defines a one-person business.

A one-person business is exactly what it sounds like – it’s a business that consists of only one employee. This employee is the owner and has responsibility for all of the business’s assets and liabilities. They also receive all of the revenue and pay all of the expenses. That means, of course, that they also keep all of the net profit.

A one-person business is sometimes, more technically, known as a nonemployer business.

So, why might someone want to operate a one-person business?

Well, we all have different personalities. And, we all do our best work under different circumstances.

Some people might thrive in an environment where they hire employees and work with a multitude of different customers and suppliers. They do their best when working with other people.

Other people, however, interacting with others makes them feel stifled. The more they have to deal with other people’s issues the less energy there is for value creation.

Running a one-person business does not mean that you do everything yourself. You can, for instance, outsource some of your responsibilities. Thus freeing yourself up for activities that are more value-added. In cases like this, the relationship is more customer-supplier than employee-employer.

When you decide to move on from your one-person business, you could sell it to someone else and they could continue to operate it as such. Or, they could elect to hire employees and take the business in a different direction. If you decide not to sell, the one-person business might cease to exist once you’ve decided to move on.

Pros and cons of being a one-person show

Here, the New Hope Network weighs in on the pros and cons of a one person company.

Pros include:

- Only answering to yourself

- Flexible work hours

- Keeping all profits

- The status from achieving everything on your own

- Following your own vision

- Not needing to compromise

- No “red tape”

Cons include:

- Being overwhelmed

- Difficulty in luring investors

- A less professional image

- Potential loneliness

- Being “too close” to your business for appropriate perspective

- No reality checks

- Wasting time (I can attest to this!)

- Assuming all the risk

There are many advantages to owning and running a one-person business. For starters, it is simple to launch. It’s also easy to terminate. With a one-person business, you can pack up and move on, the day you decide you’ve had enough (short of fulfilling any contractual obligations).

Not hiring employees means never having to worry if that expense is earning an adequate return. You never have to worry if it’s the right time to hire.

There’s no worrying about how decisions will be received by employees or the 2nd/3rd order effects of those decisions.

It’s not all upside of course. There’s a reason why many businesses choose to hire employees.

One disadvantage of a one-person business is that succession might be an issue. As I mentioned earlier, many times, the business dies once the owner is through with it.

By avoiding partners, the one-person business owner assumes responsibility for all liabilities. They are also responsible for raising all of the necessary capital.

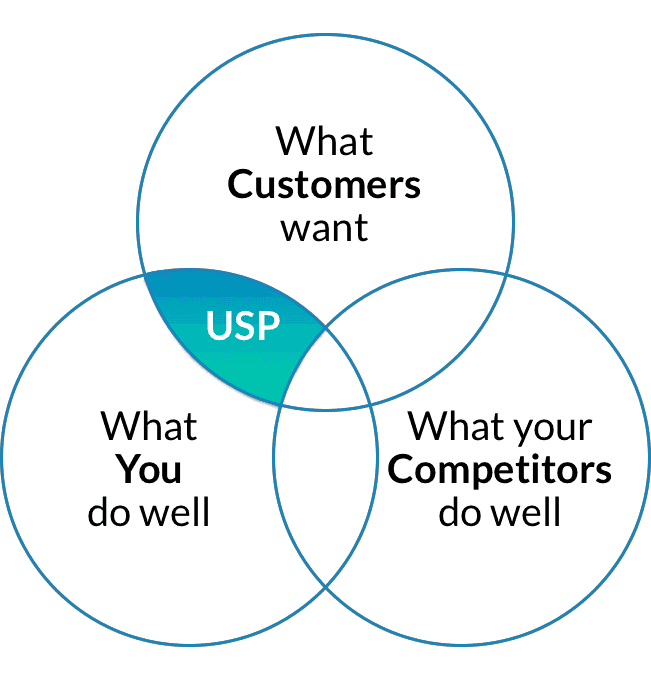

The biggest disadvantages are, however, that there isn’t necessarily anyone else available to complement the owner’s strengths and weaknesses. Though, this disadvantage could potentially be worked around by utilizing contractors or freelancers. It’s this disadvantage that can make it challenging to scale the business up and to reach its full potential.

So, if you’re considering a one-person business, make sure that you choose a scalable business model.

Best one-person business ideas

Read more about Business Alligators list of types of businesses that consist of only one person.

If you’re interested in running a one-person business, below, are some industries you might consider. What makes each option appealing is also listed.

- Finance and insurance

- Recurring revenue

- Retail

- The most popular industry in the $2.5 – $4.99 million annual revenue tier

- Real estate

- Lots of supply

- Designing

- Ability to exercise creativity

- Currency mining

- Potentially very lucrative

- E-commerce

- Availability of tools to help with the technical aspect & ability to sell worldwide

- Fast food (food trucks)

- Consistent demand

- Coaching/teaching

- A wide variety of markets

- Mobile laundry

- A growing industry

- Child care

- Consistent demand

While one-person businesses do have their limitations – they can also be very successful. In fact, there are many that top $1 million in annual revenue. Keep in mind, of course, that $1 million in annual revenue does not mean anything close to that in net profit. I think it is safe to say, however, that this level of sales is enough to put a one-person business in a position for success.

As tools for automation become more readily available, the prevalence of one-person businesses will hopefully continue to grow.

Here are some examples of one-person businesses with $1 million or more in annual revenue (Source).

The Babysitting Company was started in a dorm room and reached $1 million as a one-person business. It looks like the founder has since hired some help to handle growth.

Tools4Wisdom got its start by selling planners on Amazon. The founder grew to $2 million in revenue before hiring the company’s first employee.

Bear Mattress is another one-person business that hit $2 million in revenue. They too have since decided to hire help.

As you can see, there is something of a consistent theme with the above examples – each has decided to hire employees after achieving a remarkable amount of success as a one-person business. It could be that once they got a taste of success they decided that remaining solo wasn’t as important as it once was.

How to start a business by yourself?

People who launch one-person businesses tend to follow a similar path. It’s not for everyone, but if you’re trying to get a one-person business off the ground, here’s a rough plan to get started:

- Start your business while working full-time

- Choose a business structure

- Preferably LLC or corporation

- Focus on the most important tasks

Is it possible to start a business while working 9-5?

This Reddit post has some ideas on setting up a one-person business while employed. Here’s a summary of some of the advice given:

User jumbotron198 advises: work just hard enough to not get fired at your full-time job. Make sure you meet your responsibilities to your employer. But, as long as you’re doing that, you shouldn’t feel guilty about taking control of your own professional destiny.

User rsimmonds has a few bullet points to keep in mind:

- Stay engaged

- If your side hustle becomes a “chore,” you’ll run out of energy

- Prioritize and make a schedule

- Beware of “time sucks”

- Activities that add little value but prevent you from growing your side business

- Don’t feel guilty about taking control of your financial and professional situation

Finally, user binaryOne advises you to do what you can while on company time and utilize as much time as you can outside of your full-time job. Keep in mind that you won’t (can’t) keep up this pace forever. Take action and sort out the details later.

Starting your one-person business on the side can ease some of the potential financial stress. Plus it allows you to “work out some of the kinks” while still bringing in income.

Of course, starting your business as a side hustle also means that you’ll probably only be able to commit part of your time and effort to it. If you’re sitting on a business with a lot of potential, you could simply be delaying that glorious day when you can quit your job and work full-time on something you actually care about.

What’s the best business structure for a bootstrapping one-person business?

This Quora post offers some advice on the best legal structure for your small side business.

User Sam Mollaei suggests structuring your business as an LLC, or an S/C corporation. As a business lawyer he states how:

- An LLC will help protect your personal assets and taxes will pass through the LLC to you personally

- A C corporation will create an entirely separate legal entity from you, the owner

- You and the corporation will each be taxed separately

- An S corporation is similar to a C corp, but the taxes also pass through to you

There’s very little downside to structuring your one-person business as an LLC or corporation. Operating as a sole proprietorship comingles your finances with that of the business and puts your dream at risk due to liability (Source). My only advice would be to wait to form your LLC or corporation until you start earning revenue. There’s no point, that I’m aware of, in forming it sooner.

Productivity tips for solopreneurs

This site offers some suggestions on ramping up your side business while juggling a full-time job.

- Work on your side hustle when you are most productive

- Figuring out when that is might take some trial and error

- Use your time wisely

- Focus on tasks that are important and/or urgent

- Plan your days and weeks in advance

- Group similar tasks together

- Use a timer to stay focused

- Take notes

- To remember ideas and to sort out your thoughts

- Eliminate distractions

When you’re going solo, everything is on your shoulders and that can get a little overwhelming. If you’re starting your one-person business on the side, you have that much less time to handle it all.

Try to focus on those tasks that add value (i.e. revenue). It can be tempting to work on less important, or vanity projects if you are earning an income from a full-time job. The link above also recommends:

- Setting goals

- Short and long-term

- Blocking off time for critical tasks

- Staying organized

Starting a side business and turning it into a successful one-person business is going to take discipline. My only caution would be to avoid becoming your own tyrant. Don’t become the annoying coworker or manager that you’re trying to get away from.