Do you know everything you need to about pricing? Read this:

5 PRICING STRATEGIES: GAIN MARKET SHARE FOR YOUR SMALL BIZ

You’d like to be able to charge more for your small business’s products or services. However, you feel pressure to sell for near or below what your competitors do. Otherwise, your customers will go elsewhere, right?

“What Are Features vs Benefits of a Product?” The Difference

However, every dollar more that you can charge is (likely) an extra dollar in profit. Bringing in more revenue would help your small business with cash flow and would contribute to achieving your goals. You know that better pricing strategies exist, but maybe you’re not sure how to implement them?

Is every business forced to compete on price? Everybody knows that, to a greater or lesser degree, you get what you pay for. Most people, at some point, have “spent a little extra” but felt like they got their money’s worth.

Do you know everything that compels your customers to buy, besides price? Unless you’re selling highly commoditized products, I’d say it’s unlikely that price is the only purchasing decision.

Why not sell your products and services at a bare minimum, then? Only make enough profit to stay in business – assuming that nothing unexpected happens. Customers are the only side of the transaction that matters after all…

How do your (potential) customers make buying decisions – have you asked them? Think about this, along with what it is that you do better than anyone else. The better you understand variables, beyond price, the better position you’ll be in to maximize your small business’s revenue and potential.

What would really happen if you raised your prices? Sure, it’s probable that some customers would leave. I’m betting it wouldn’t be your best customers. In fact, for a lot of small businesses, I’d hazard to guess that earning more revenue from “good” customers and having less hassle from the “bad” customers would be a very welcome development.

Simple Small Business Cash Flow Template, 7 Week Projection

About value-based pricing

Understanding how much your customer thinks a product is worth is important. That’s why companies try to price their products with what the customer values in mind. This type of pricing is customer-focused. Companies that employ this strategy have to make sure they are meeting customer needs.

Value-based pricing is an approach to pricing products and services that focuses on the value provided to the customer rather than the time or cost incurred by the provider.

Value pricing can be contrasted with cost-based pricing. Cost-based pricing focuses exclusively on the costs incurred to bring a product or service to market.

Since the perceived benefits from a product or service can far exceed the cost it took to create it, the potential for a small business to earn extraordinary returns is very high.

How to convey value to customers?

It is important to know the value of your products and services. If people don’t think they are getting their money’s worth, then you have no power to raise the price. But if people believe they are getting their money’s worth, then they will stay with you even if you raise prices.

“How Do I Write a Marketing Business Plan?” Breaking It Down

Small businesses need to be careful with value pricing, however. If you overestimate how much the customer values the product or service then, it’s possible, that sales will suffer. It’s rare that customers will willingly overpay for something.

Emotion plays an important part in value-based pricing. It’s emotion that drives the desire to purchase a product or a service.

Whereas value can determine price, price can also convey value to the customer. Counterintuitively, not having a relatively high price can communicate a lack of quality to customers. Even if that’s not necessarily the case.

By its very definition, we know that the more value a small business can create for customers the more it can charge. So, how to create and convey all of the value you’re providing?

Be authentic and transparent

Deliver on what you promised to customers. Both explicitly and implicitly.

Customers are customers, not employees. So, don’t expect them to spend additional time and money handling things that should have been handled by you. Make doing business with your company easy, not a chore.

Draw a distinction between you and your competitors

Your customers aren’t stupid. They know that they could spend their money elsewhere. So, there’s no point in pretending that you don’t have competitors.

Highlight where you’re strong and they’re weak. Where the opposite is true – try to shore those weaknesses up.

Frustrated With Your SWOT Analysis? 15 Templates To Download

Customize as much as possible

Every customer is unique. Even those within the same market segments.

Not every business model is built for customization. However, try to look for ways to get closer to giving your customer exactly what they want.

Follow up (gently)

If practical, follow up to make sure the customer is satisfied with their purchase. Most times, they should be. If they’re not, this is a good opportunity for feedback.

Get testimonials

Customers believe other customers. Frankly, more than they believe you. Reviews and testimonials provide valuable social proof that provides very real justifications for raising your prices and increasing your profit.

Make giving testimonials and positive reviews easy. Provide an incentive if you can.

Calculating a value-based price

Value-based pricing is a way to set a price. You start by figuring out what your product is worth, or how much someone might pay for it. This can be confusing because some people think that they should charge as little as possible.

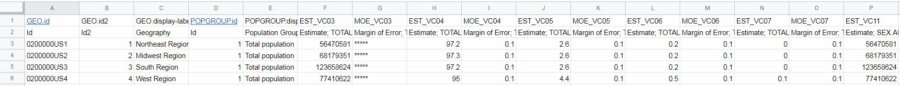

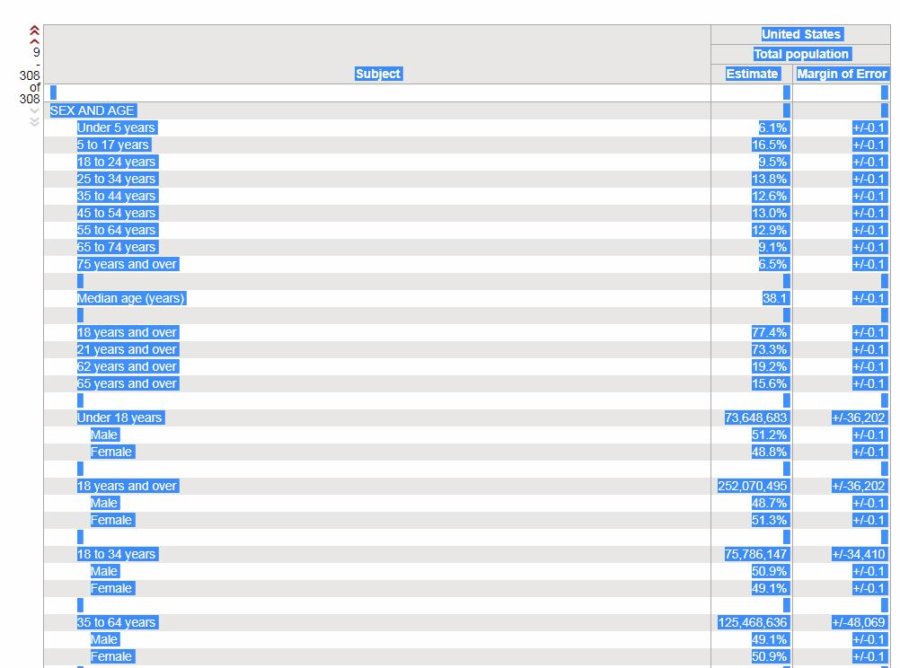

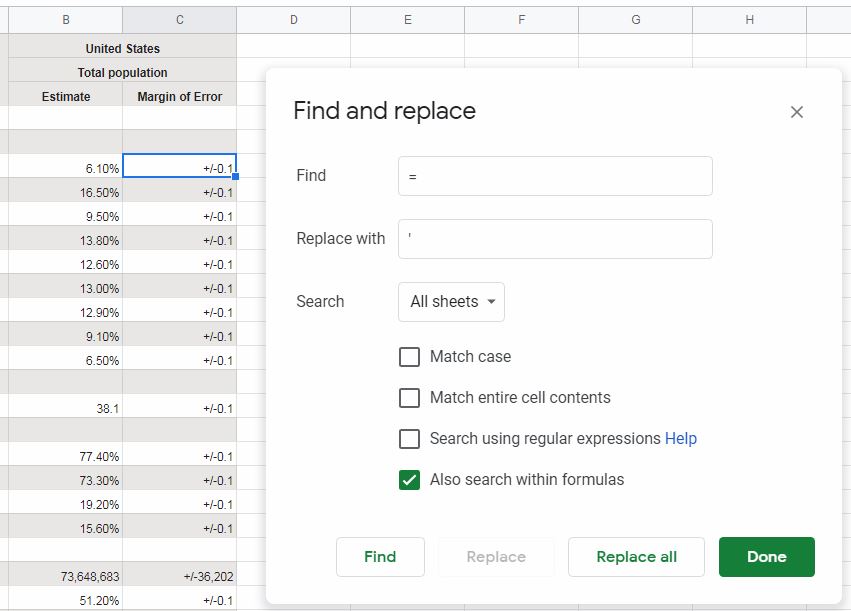

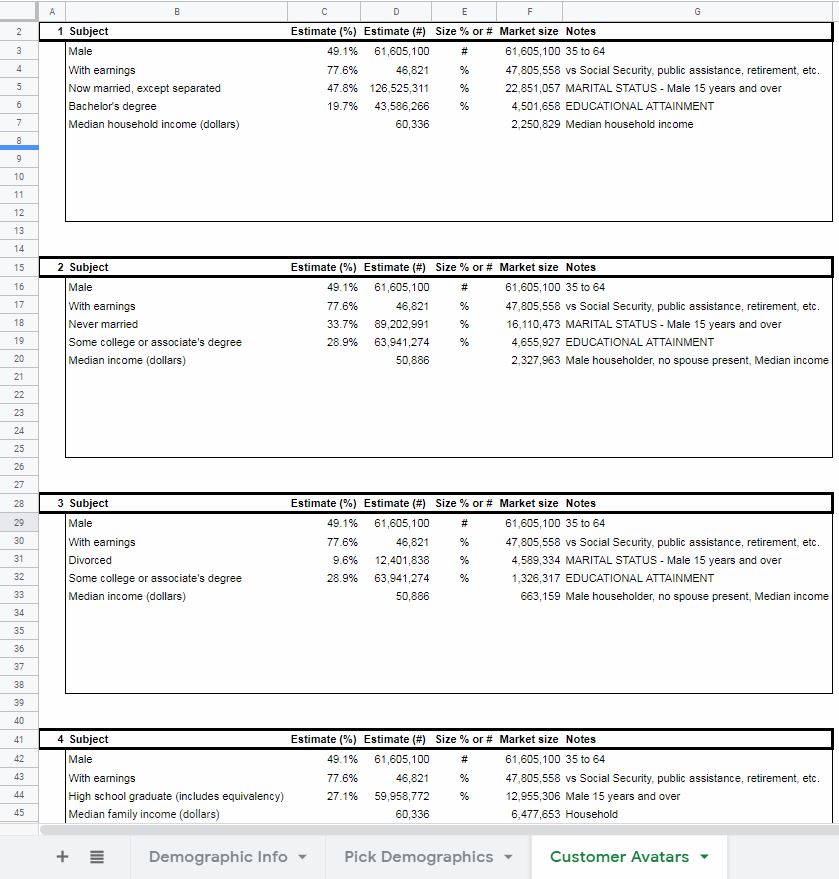

Data about customers and their purchasing patterns can help drive value pricing decisions. Analyzing this data can help you decide what your customers value. CRM software can help with this.

The problem is – nobody is really average and every individual values different things. It’s not advisable or even practical to charge each individual a different price based on what they value.

What Is a Sales Strategy Example for a Business Plan? 6 Tips

Here is how one marketer suggested that you set value-based prices:

- Think about what your customer would spend that money on if they didn’t buy your product or service

- Find out the price of that alternative

- Consider the ways your product or service is better (more valuable)

- Settle on a monetary value for those differences

- Consider how the alternative is better

- Settle on a monetary value for those differences

- Price of the alternative + value of your superiority – value of their superiority

Keep in mind that this will likely only work with products or services that are direct substitutes.

Advertising Digitally: Novice Guide for Small Business

Advantages of value-based pricing

- Save time

- Increase profit margins

- Simplicity

- A focus on quality

Marketing your product or service with value in mind is a great place to start. It actually puts you into the mind of your customer. This helps ensure that you are giving them what they want.

Save time with value pricing

Most businesses are trying to get as many eyeballs on their products and services as possible. Since value pricing forces you to get into the mind of your customers, you’ll better define your customer segments. More importantly, you’ll not waste time on those customer segments that aren’t interested in your small business’s products and services.

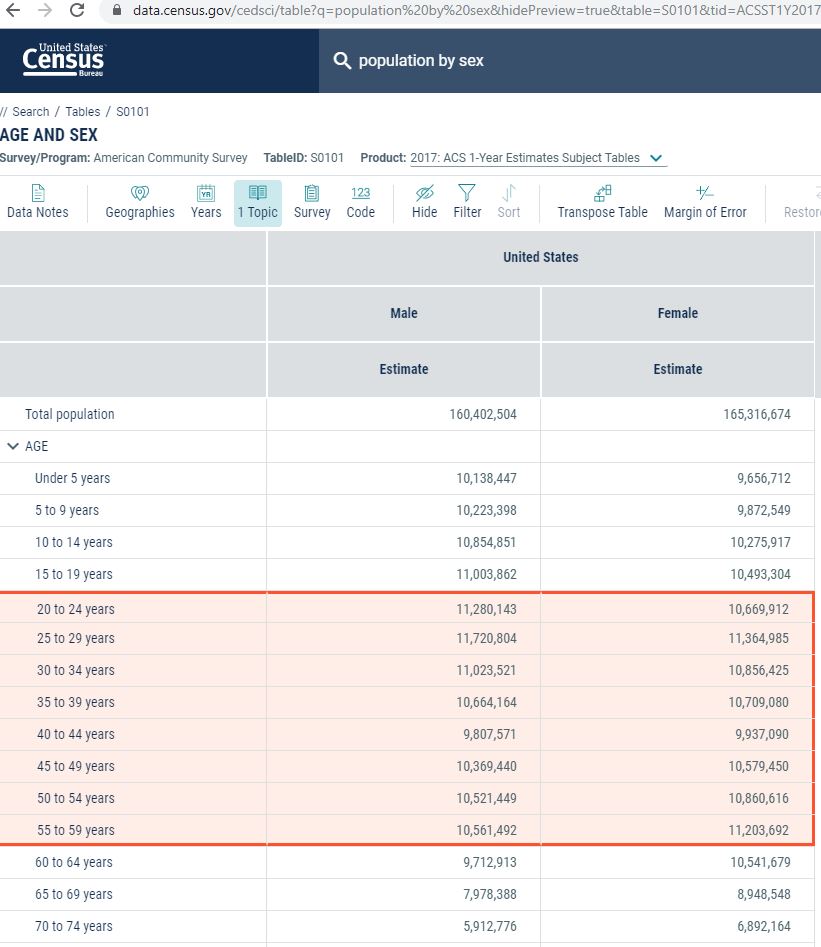

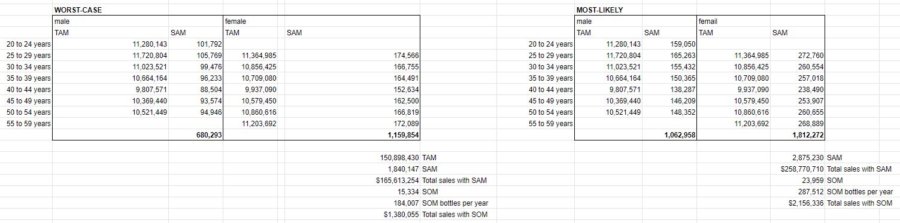

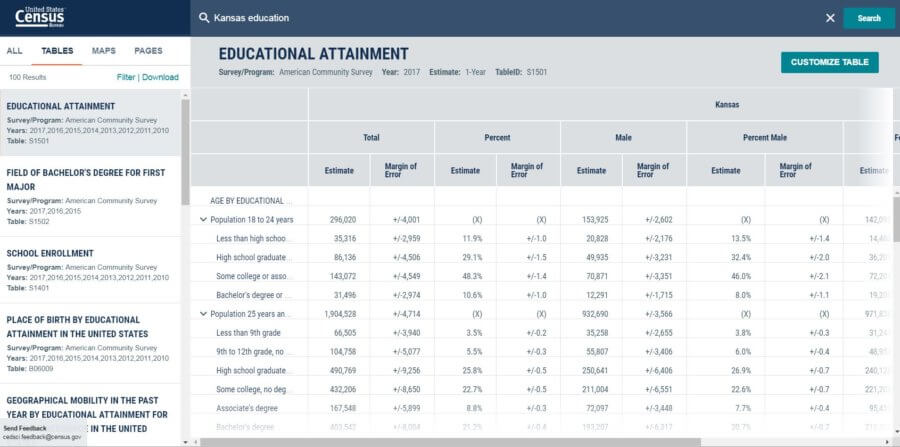

Business Plan Demand Analysis, Four Things to Consider

Higher profit margins

Not every small business has a good grasp on its costs. This makes discounting dangerous. If you haven’t allocated all your costs in a meaningful manner, you could be losing money on sales.

Alternatively, by focusing on value pricing, your presumably getting the most revenue possible out of every sale. You still need to know your costs. However, your likelihood of maximizing profit is much higher versus an alternative strategy.

Activity-Based Costing vs Traditional – Steps & Example

Simplicity

Not every small business owner is a math or accounting wiz. That’s absolutely fine unless you are selling math or accounting services.

Once you get a feel for value pricing, you might find it simpler than, say, a cost-plus method. You might find it more intuitive.

Promoting quality instead of quantity

Value-based pricing isn’t just about selling more products or services, it’s also about selling better products with higher quality standards.

Value pricing makes you focus on what you are providing your customers. So, you have quality on your mind. Contrast this with a discounted pricing strategy where you’re starting from a point of cutting costs (and likely quality). Even if prices are higher, your customers might appreciate a focus on quality.

Disadvantages of value-based pricing

- Different markets might have different values

- Subjectivity

- Time-consuming

Every decision has upsides and downsides. There are disadvantages to value-based pricing that you should consider when deciding if it is suitable for your small business.

Different markets, different prices?

One of the most notable disadvantages of value-based pricing is that different niches will have different values. Having niche markets for customer loyalty purposes is good. But, it may also mean that certain niches may get over or underpriced. That, or you have to charge different prices to different markets. Which, can get tricky.

Challenging to set the prices

This might seem to contradict the “simplicity” advantage. But, it all depends on where your strength lies.

If you’re a more quantitative-minded small business owner, then a cost-plus pricing strategy could come more naturally to you. The nuance of a value pricing strategy might elude you.

Time and effort

If value pricing proves to be challenging to you, it could take an inordinate amount of time. Time that could be spent on other aspects of your business. Generally speaking, given the importance of pricing, even if it is time-consuming, it is most likely time well spent.

Benefits probably outweigh costs

Competing on price is a losing battle. There are only so many costs that can be cut. Plus, low margins put your small business at risk of cash flow issues and impede growth.

A little thought and a little research will help to uncover what it is that your customers value. Highlighting the value you are giving your customers will reassure them that what they spent was worth it.

Anecdotally, I’ve never seen a story where a business was regretful for raising prices. Granted, this could be an issue of survivorship. But, I think, generally speaking, raising prices (and conveying value) offers a bigger upside for your small business than downside.