Video slides

Video transcript

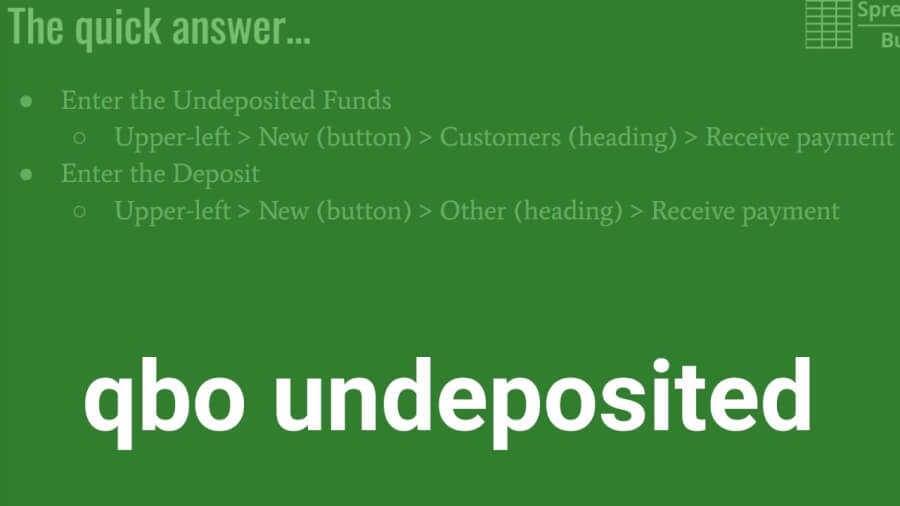

00:00 QuickBooks Online and deposited funds

00:01 the best practice for handling them

00:06 quick answer is to enter the undeposited

00:10 funds and then enter the deposit so

00:15 undeposited funds are entered the upper

00:18 left the new button under customers and

00:23 receive payment and enter the pertinent

00:31 information there and choose your

00:32 invoices and after that when you

00:37 actually make the deposit in the bank

00:38 you also come up to the new button under

00:42 other bank deposit you’ll enter the

00:46 pertinent information up top and then

00:49 you’ll check your undeposited funds and

00:52 that you’re going to deposit okay so I’d

01:00 like to start every video on with a

01:01 quick answer like that and then after I

01:03 get into a little detail so what are

01:07 undeposited funds for starters

01:09 these are receive checks there may be

01:12 cash that aren’t yet deposited into the

01:17 bank so you want to record them as a

01:19 sale you want to send a customer a

01:23 receipt you want to acknowledge that an

01:26 invoice is no longer outstanding and the

01:30 reason you want to do that is because

01:32 you know it’s kind of a thing I’ve

01:36 always preached that you want your

01:37 software your accounting software to

01:41 match reality you want it to reflect

01:43 reality because that’s its job is to

01:46 reflect the reality of your business so

01:48 that’s why you acknowledge that this

01:51 cash has been received but you know

01:54 again the reality is also that it is not

01:56 yet been entered into or deposited into

01:59 your bank account so it allows you also

02:05 when you when you make a deposit you

02:07 know probably a lot of businesses are

02:09 going to batch a lot of checks together

02:11 you know

02:12 from client one client to client three

02:14 and client for you know for $100 each

02:17 let’s say for a $400 deposit will your

02:20 bank statements gonna reflect a 400

02:22 dollar deposit you know if you didn’t

02:25 enter these undeposited funds

02:28 individually you know the the for $100

02:32 payments you received then you know

02:37 you’d have a tough time matching it to

02:41 your bank statement okay your bank

02:43 statements gonna say 400 you’re gonna

02:45 have for $100 payment receipts so he

02:50 said this way

02:51 QuickBooks knows it was these four

02:53 payments that comprised that $400

02:57 deposit hope that makes sense we’ll get

03:01 into a little more detail here okay so

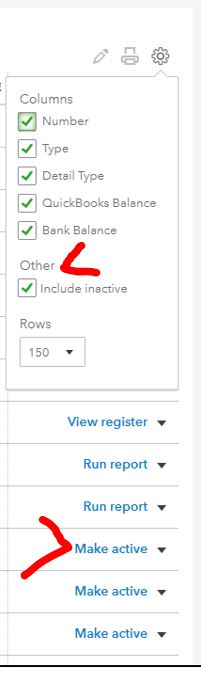

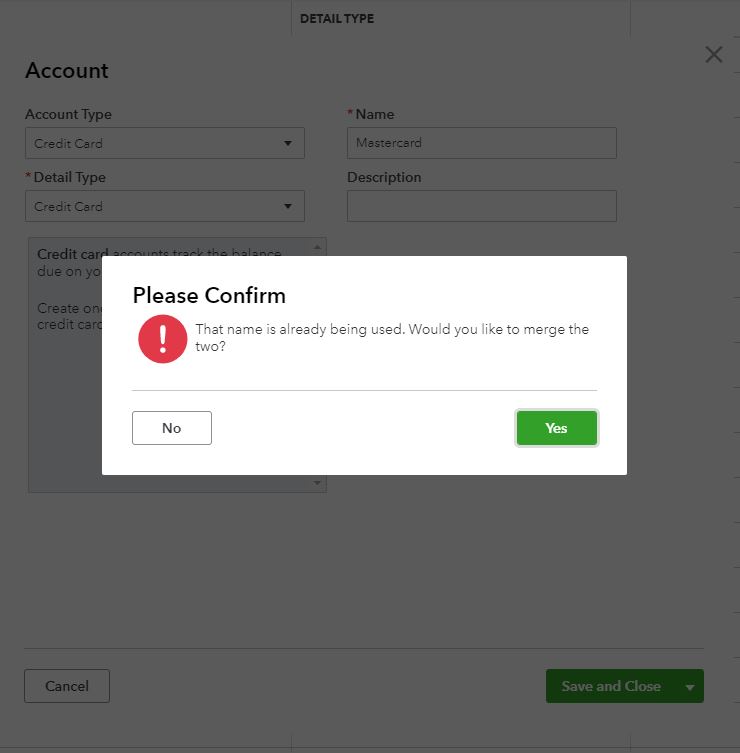

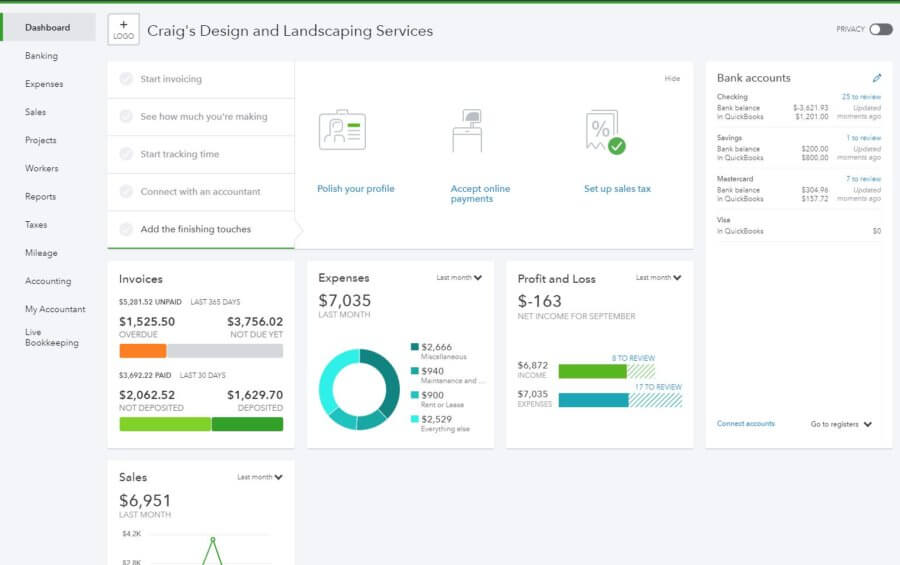

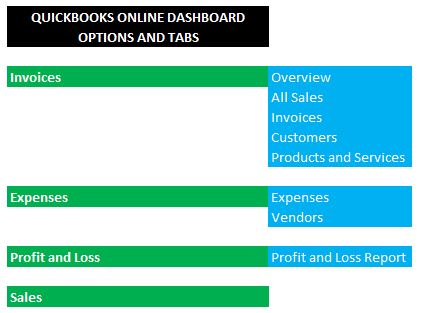

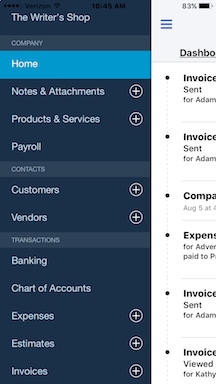

03:04 back to entering undeposited funds as I

03:08 mentioned in the upper left there’s the

03:10 new button the customers heading in the

03:12 received payment okay let’s go back to

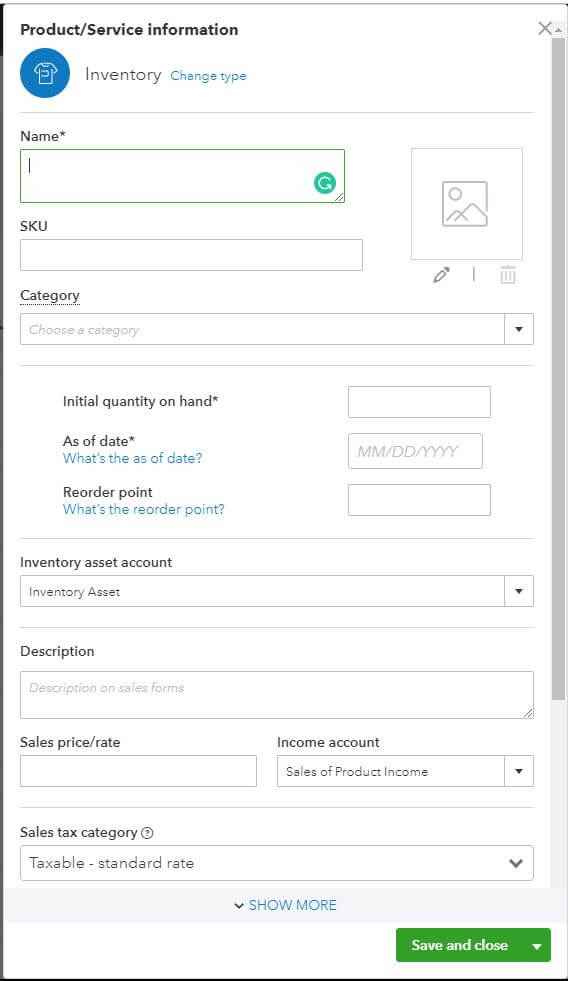

03:15 that screen all right so the first thing

03:23 you’re gonna do is enter the customer

03:25 who made the payment of course and we’ll

03:28 just pick someone at random from this

03:30 list who hopefully I was outstanding

03:32 invoice they do so I picked Red Rock

03:36 diner and then the date the payment was

03:39 made okay that’s gonna be reflected on

03:42 the receipt and they you know again you

03:43 want that they made payment yesterday

03:46 but you didn’t get a chance to enter it

03:47 into QuickBooks until today you want to

03:49 change that to yesterday’s payment

03:51 payment date you can honor the payment

03:55 method cash check or credit I’m not sure

04:03 when credit would apply there might be

04:07 circumstances since I have it as an

04:08 option but typically I would say it’s

04:11 going to be cash or cheque and then a

04:14 reference number this could be your

04:16 customers cheque number or some other

04:18 unique identifier so if need be if there

04:21 was a problem or you needed to do

04:23 some digging around on something you

04:25 could have a valid reference number like

04:32 I said you can put a check number in

04:33 there and you want to put it in

04:36 undeposited funds is you I guess right

04:41 that’s probably why credits in here

04:43 because this is receive payment it’s you

04:45 know this is what specifies that it goes

04:47 to undeposited funds so you could

04:49 obviously receive a credit payment and

04:52 you know but not probably wouldn’t put a

04:56 ton to positive funds so and after you

05:01 enter that information up there like I

05:06 said put it under positive funds go the

05:07 next slide here if it’s in response to

05:11 an invoice then you’re gonna match click

05:14 the checkbox next to the appropriate

05:15 invoice and that is it so let’s say that

05:19 our customer Red Rock diner paid on this

05:25 hundred fifty six dollar invoice and

05:27 that’s gonna reflect down here the 70

05:31 dollar invoice is still outstanding

05:32 you can click either save and new to

05:36 enter a new undeposited funds for a new

05:39 client or if that’s your last one save

05:43 and send we’ll send a customer a receipt

05:45 so even close will do exactly what it

05:48 says and close it take you back to the

05:52 dashboard there okay so you know you’ve

06:00 entered all of your undeposited funds

06:04 and now you’ve come back from the bank

06:11 where you actually made the deposit into

06:13 your checking account so we’re savings

06:17 you want to enter that into QuickBooks

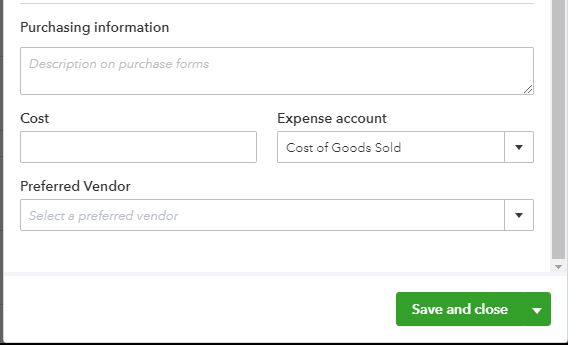

06:19 so that is also a bit new and it’s under

06:23 other bank deposit

06:31 and let’s see what do we do we just did

06:35 Red Rock diner tastes assy

06:38 well first you want to select your

06:41 account that you’re going to put it in

06:43 which most times would be checking I

06:46 imagine perhaps savings the date you

06:49 made the deposit again if you made a

06:51 deposit this also helps with if you made

06:53 it yesterday

06:55 if you made it yesterday make sure you

06:57 pay yesterday because this will also

06:59 help with you know reconciling your

07:02 checking account again you want your

07:04 accounting software to match reality so

07:08 select the accountant a date we hit the

07:12 check box next to the appropriate

07:13 undeposited funds that we deposited and

07:17 it’s a similar sort of thing you can see

07:21 Red Rock diner the date all the

07:23 information we entered previously you

07:27 have a chance to edit it here

07:29 and I can do save a new to enter another

07:33 bank deposit or save and close’ will do

07:37 save and close the show we deposited at

07:39 one hundred fifty six dollars and there

07:41 we go our transactions and QuickBooks

07:44 Online match what actually happened in

07:47 reality so that’s it it’s a pretty

07:54 straightforward sort of thing the

07:55 intuitive to enter and as long as you

07:58 understand why it’s important to enter

08:00 undeposited funds and you know the

08:04 detail and again have that information

08:06 in your accounting software match

08:08 reality you know when saying with the

08:12 deposit then yeah it was really good

08:15 like I said it’s a pretty simple thing

08:16 to do so anyhow if you know that’s

08:21 simple some other bookkeeping tasks

08:23 aren’t as simple and bookkeeping isn’t

08:25 everybody’s cup of tea particularly if

08:27 you’re a small business owner you know

08:29 your your expertise is in your craft you

08:33 know whatever whatever you’re selling

08:35 and you know bookkeeping might be a

08:39 chore for you so if that’s the case you

08:42 check out ba keeper there’s

08:44 link down in the description and what ba

08:47 keeper is basically a bookkeeping

08:50 service that utilizes artificial

08:54 intelligence to handle the bulk of the

08:58 workload and then also implements a

09:00 human element to kind of qualify things

09:03 to you know to double check to make sure

09:06 everything’s going alright so what you

09:08 know what it does though allows you to

09:11 work more on your business and less on

09:13 data entry and you know spend more time

09:17 pumping to grow so if you find in

09:20 bookkeeping to be a chore definitely

09:23 click on that link and just check it out

09:26 and see if it’s something that might

09:29 help and make your life easier so that’s

09:33 it for this video you like you know it

09:37 is format with every quickbooks online

09:41 every video that i post you know or have

09:45 been posting recently is start out with

09:47 the quick answer so you can get the

09:50 information you need right off the bat

09:51 and then doing a little more detail on

09:53 the subject matter if you like that

09:54 format being short to the point up front

09:57 and detailed and do the rest of the

10:00 video you could show that that you like

10:05 that by giving the video a like and you

10:07 find yourself searching for quickbooks

10:09 online how to videos fairly often or you

10:11 think you might search in the future you

10:13 can subscribe and then you’ll know to

10:14 check spreadsheets for business first to

10:18 see if i covered the subject and that

10:21 mean quick and easy for you so so I got

10:24 appreciate you guys watching

10:26 take care